Friday the 13th – Should Be Good For Shorting – Price Action Improving

TRADE WITH ME TODAY - TAKE THE FREE TRIAL

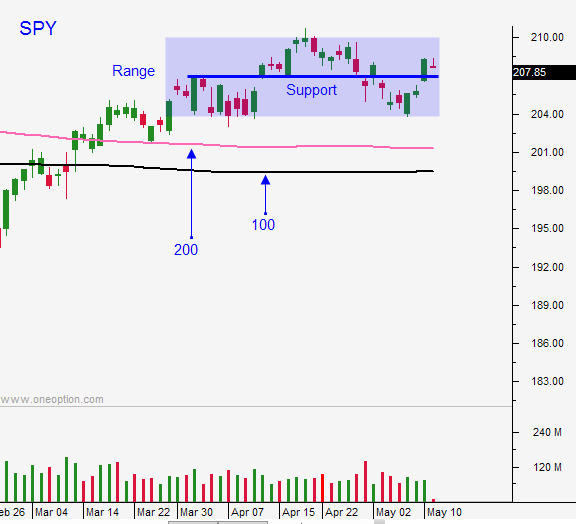

Posted 9:30 AM ET - Even though it's Friday the 13th, this should be a good day for trading. Yesterday the market had a nice range and we saw two-sided price action on better volume. This morning, the S&P 500 has been down nine points and back to unchanged. This type of movement will set up some good opportunities and my bias is bearish today.

There is some concern that China's economic numbers (industrial production, GDP and retail sales) will come in light this weekend. The PBOC has been pumping liquidity into the system and some also believe that they might take their foot off the gas. Non-performing commercial loans hit an 11-month high and new loans were shy of expectations. This news is not earth shattering, but it will weigh on the market.

The FOMC minutes are the only economic release of interest next week. Their comments were a little more hawkish during the last meeting since global risks have subsided. However, the dismal jobs report will subdue any rate hike worries.

Apple broke major horizontal support yesterday and it made a new low for the year. Tech has been weak and the QQQ has broken the 100-day and 200-day moving averages. The market won't be able to rally without these stocks.

I am long VXX and BZQ. Yesterday I bought a few puts in July on weak stocks. I won't get aggressive with my shorts unless we close below SPY $204.

I want to trade from the short side this morning. I was finding excellent shorting opportunities yesterday. Retail and HMOs were nailed and the bid was very soft. Many stocks are rolling over and I'm looking for compressions at the top of the range and breakdowns through horizontal support. If accompanied by a sell signal from my system, my probability of success is very high.

Look for an attempt to rally the market back to unchanged this morning. When that bounce stalls, an excellent shorting opportunity will present itself. Profit-taking is setting in and the bid has weakened. If we make a new low after one hour of trading, we could drift lower all day and test $204.

The early price action is excellent and I believe we will trade outside of the first hour range today. Use that range as your guide for day trading.

Will be very active in the chat room today. Take the free trial and watch us make money.

.

.

Daily Bulletin Continues...