FOMC Minutes Will Be More Hawkish – Rate Hike Worries Won’t Be An Issue

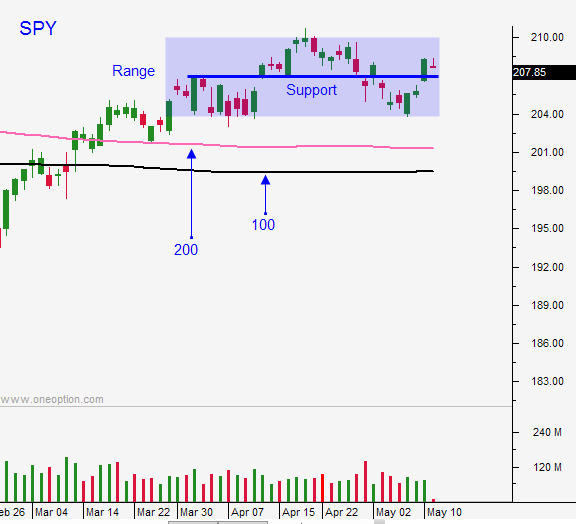

Posted 9:30 AM ET - Yesterday the market rallied and it floated back into the middle of the range. Once the early momentum is established, stocks tend to continue the move the rest of the day. We are in a news vacuum and this pattern will continue.

The FOMC minutes will be released tomorrow afternoon and that is the only significant news this week. We can expect a more hawkish tone, but the soft jobs report in April will keep rate hike worries in check.

The action will slow down next week ahead of Memorial Day. Our only chance for sustained price movement is a breakdown below SPY $204. I was hoping we might see that, but it looks less likely after Monday's rally.

I will use the first hour range as my guide. If the SPY is above it, I will trade from the long side. If the SPY is below it, I will trade from the short side.

Day trading is my bread-and-butter. I do have some bearish overnight risk exposure. I will exit my VXX long position today. Option implied volatilities will decline over the next two weeks and I will reenter the trade after the holiday. BZQ is a longer-term position and I will hold it. I also own some July puts on various stocks. They did not rally with the market and they are weak on a relative basis. If the market continues to march higher, I will exit these positions and I will take my lumps.

The market will probe for support this morning. If it makes a new low for the day after one hour, we are likely to drift downward the rest of the day.

Keep your overnight positions small and day trade using the first hour range as your guide.

.

.

Daily Bulletin Continues...