Soft Jobs Report Will Keep Fed Sidelined – Market Bid Will Strengthen

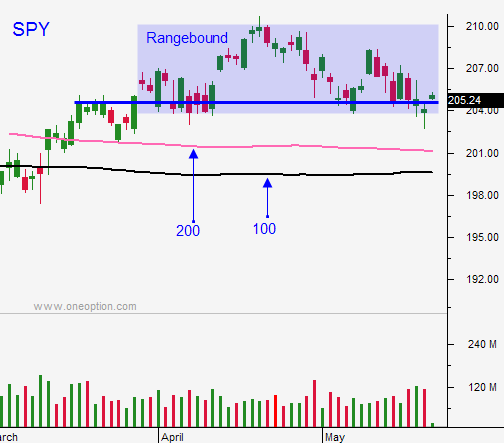

Posted 9:40 AM ET - Resistance at SPY $210 is holding. The market probed for support yesterday and it is a little soft this morning. Holidays typically suck the life out of the market and we can expect low-volume today.

Official PMI's were in line and they barely moved the needle.

The Street is modeling for 160,000 new jobs on Friday. That number seems a little light and it could spook investors. I would prefer to see something in the 180,000 to 200,000 range. That would keep the Fed sidelined and it would suggest sluggish growth.

The FOMC will meet in a week and the tone should be more dovish. Lackluster job growth and uncertainty surrounding Brexit should soften the rhetoric. This will strengthen the market bid.

Traders are pricing in a "Stay" vote in England. It would probably result in a 2% rally and we could make a new all-time high. If by chance England votes to leave the EU, I believe we could see a 10% market decline. Until then, everything else is just noise.

Earnings season is over and there's nothing to drive the market.

I believe we will probe for support today and I will favor the short side.

Oil is pulling back and energy stocks could roll over. I like shorting basic materials and the fundamentals don't support current price levels.

Use the first hour range as your guide. If the market is below it, stick to shorting stocks. If the market is above the first hour high, trade from the long side.

With the exception of my position in BZQ, I am not carrying other overnights. By the way, this position has been fantastic.

Try to make your money in the first two hours and set targets. Focus on day trading.

.

.

Daily Bulletin Continues...