Brexit Vote Resulting In Choppy 2-Sided Action Last Two Days

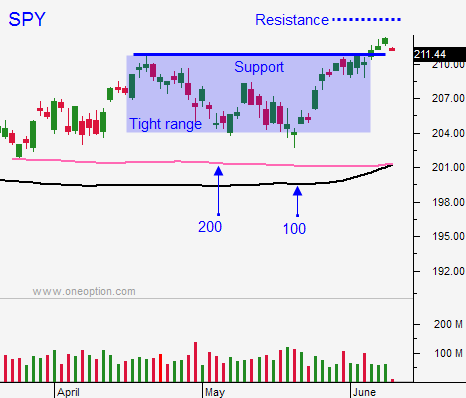

Posted 9:30 AM ET - Wednesday the market should have rallied on dovish remarks from the FOMC. When buyers could not push the market higher, profit-taking set in and stocks retreated. Yesterday, the market was down before the open and it looked like Brexit worries were going to spark a big round of profit-taking. If that move had gained traction, quadruple witching would have added fuel to the fire. The market found support and it rallied all the way back.

We are seeing two-sided price action and that is likely to continue ahead of a binary event. The Brexit vote is on everyone's radar. It was not getting the attention it deserved a couple of weeks, but now traders and central banks are fully aware of the impact it could have.

The biggest surprise would come on the downside if England leaves the EU. Currency markets would be in a flux and credit issues will surface. Central banks will be injecting liquidity this week and financial institutions are overstaffing trading desks.

If England stays in the EU, the market will rally to a new all-time high. If England leaves the EU the SPY will test $190.

Either way, this outcome will drive prices for the rest of the summer.

Polls still give the edge to Brexit by a slight margin. If that continues I believe we will see some selling next week. The results will not be known until Friday.

My call for a big market selloff yesterday was wrong. I shorted the S&P right on the opening bell and I had a large position. I also shorted stocks. When the market was unable to drift lower, I took profits. I made nine points on my S&P trade and I made some money on my shorts. I was expecting a bounce and another wave of selling. I waited for a compression and a breakdown below that compression. It never happened so I did not get short. The market did compress, but it broke out to the upside and we saw that pattern the rest of the day.

The key to trading this market is to stay flexible. Given the two-sided action we've seen I believe the market will establish a range today and we will stay in that range. When we get to one extreme or the other I will fade the move. Our edge is trading relative strength and weakness. If the market breaks out, I should be able to cover my positions at a very small loss (and I might even make money). Then I can shift gears and trade the breakout. If the market breaks out from the first hour range, favor that direction. If the market stays in a range, trade both sides and fade the extremes.

Quadruple witching will produce some nice moves today and I'm expecting back and forth action within the range.

If by chance we get a big rally, I will buy VXX and I might buy BZQ. I will ease into these positions and I plan to be out before the Brexit vote.

Stay flexible and set targets.

.

.

Daily Bulletin Continues...