Mega Cap Tech Earnings and the FOMC Will Keep A Bid To the Market

Posted 9:20 AM ET - The market action has been extremely slow. Earnings season is presenting some individual opportunities, but the macro news is light.

Flash PMI's were little soft, but they did not move the market. The S&P 500 is up two points before the open and it looks like another quiet day.

Mega cap tech stocks will report results next week and that should keep a bid to the market. The Fed will not raise rates next week and that should also be a market friendly event.

The market has one more good push higher and the price action should be bullish the rest of July.

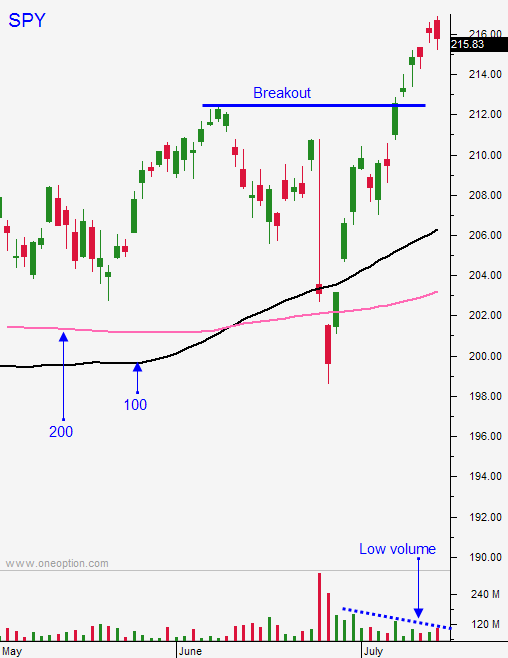

August is typically a weak month and I expect to see some profit-taking. Fear of a September rate hike will spark selling and the market will test the breakout.

I suggest sticking with your longs and gradually scaling out next week. Set targets and take profits on overnight positions.

Keep your day trades small and be extremely selective. I have been waiting patiently for the right set ups. Stocks that show strength out of the gate need to settle down before you buy. Sometimes that happens after 30 minutes and sometimes you have to wait an hour or more. I want to see pullbacks from the high and a compression. Once the stock breaks out of that compression I buy. If the stock is extremely strong, it will compress on the high of the day when the market is pulling back. In these instances I will buy the breakout as soon as the market finds support.

If you are a day trader, take my one-week free trial and I'll show you how we do it in the chat room.

Look for quiet day and bullish price action through next week.

.

.

Daily Bulletin Continues...