Market Selling Pressure Will Increase In Coming Weeks – Here Are 2 Good Plays

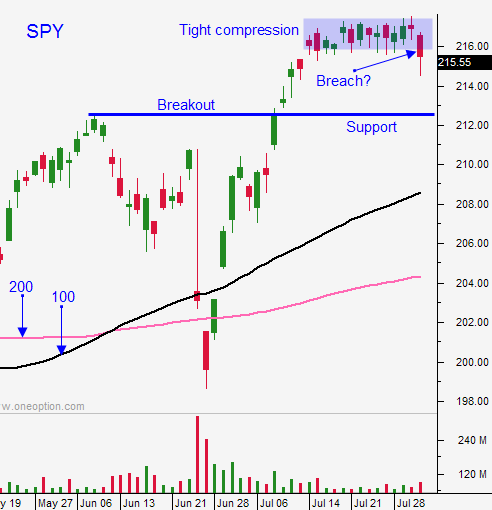

Posted 9:30 AM ET - For the last week I've been urging you to take profits on overnight long positions. The likelihood of an "ugly day" was high and we got one yesterday. The SPY breached key horizontal support at $215.75, but the damage was relatively contained. Stocks rebounded late in the day and the market could easily float back into its range.

ADP was perfect this morning. In July 179,000 new jobs were created in the private sector. That is strong enough to suggest sluggish growth and soft enough to keep the Fed on the sidelines.

Europe's economic numbers have improved slightly and official PMI's were in line. ISM manufacturing came in a little better-than-expected and ISM services will be posted today. I'm expecting a market friendly number.

Analysts are expecting 180,000 new jobs when the Unemployment Report is released Friday. That would be a Goldilocks number and the market will not have much of a reaction.

We are in the summer doldrums and the news will dry up dramatically next week.

As August unfolds, credit concerns will start to surface. Brazil is in dire straits and that will become apparent during the Olympics. Fear of a September rate hike will increase and I'm expecting a light round of profit-taking. August and September are typically weak months.

Good news is priced in and earnings will not excite investors. Asset Managers won't chase stocks at an all-time high.

It would seem that this is an ideal backdrop for option premium selling strategies. Unfortunately, implied volatilities are near historic lows and you're not properly rewarded for the risk you are taking. One small move in either direction could be problematic.

Option buyers are faced with a market that has no momentum and time decay is an issue. Stocks that are up one day are down the next. There are times when it's wise not to trade options and this is one of those times.

Implied volatilities are extremely low and I will start buying VXX in the next week or two. I have been buying BZQ for a swing trade. This is a play on Brazilian credit, commodities and optimism ahead of the Olympics. I believe the hangover after this party will be nasty.

This is a day trading environment and here is my approach. If the S&P moves more than five points on the open I am fading that move. If the market is up I am looking for relative weakness and I am shorting stocks when the momentum stalls. If the market is down I am looking for relative strength and I am buying stocks when the momentum stalls. We are likely to see choppy price action and back-and-forth moves within the range that is established during the first two hours of the day.

Day traders need to set passive targets. Good entry points are critical and you have to take profits as soon as the move stalls. I've been able to find 4-5 good trades per day and this is been a great way to make money during a flat market. As I tell chat room members, “If you can make money in this market you can make money in any market." When the volume and momentum return making money will be easy.

Prepare for quiet trading and know that the selling pressure will gradually build in coming weeks.

.

.

Daily Bulletin Continues...