Fed Minutes On Wednesday Could Spook Investors – Very Slow Week Ahead

Posted 9:30 AM ET - Prepare for another boring week. Traders are looking for anything to sink their teeth into during this news vacuum. Volume on the exchanges is down over 50% and we can expect a quiet week with tight daily ranges. There is a potential speed bump ahead.

The FOMC minutes will be released on Wednesday and they are the highlight of the week. Fed comments were more hawkish during the last meeting. Labor conditions have improved and Brexit turned out to be a non-event (might not happen until 2019). The last labor report (255K) was hot and some investors might fear a rate hike. As I said earlier, traders are looking for anything they can sink their teeth into.

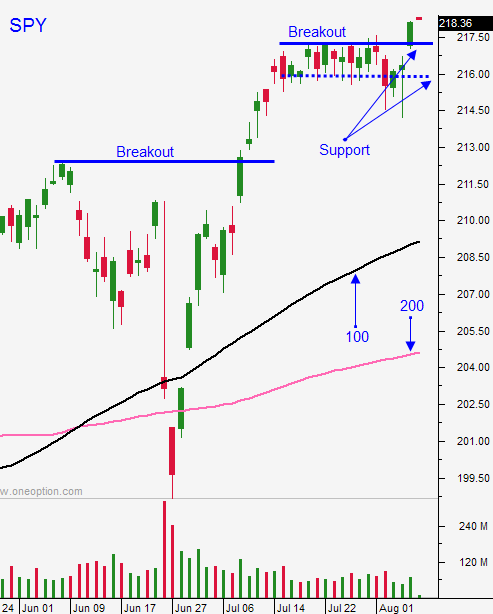

As long as the market stays above SPY $217.50 I will favor the long side. That breakout through horizontal resistance now represents support.

I am finding decent trades on the short side as well.

In this environment is important to reduce your size and your trade count. Choppy random moves are difficult to predict and your probability of success is lower. Set passive targets and expect smaller profits. We don't have a market tailwind to fuel moves.

I have only been trading the first few hours of the day and I am only looking for a handful of good trades each morning. We've been able to find them in the chat room and we are making good money. If you can find success under these market conditions, you can make money in any kind of market.

Tread carefully and don't force trades. Let the market open and spend the first 30 minutes evaluating stocks and evaluating the action. The "real McCoy's" will show themselves if you are patient.

.

.

Daily Bulletin Continues...