Money To Be Made Even In A Flat Market – Here Is A Day Trading Lesson

Posted 9:30 AM - My comments remain the same as the market chops around on light volume. Even the FOMC minutes could not spark any action yesterday.

We can expect light trading the rest of the week. Rather than to rehash the same old same old, I thought I would highlight a trade from yesterday.

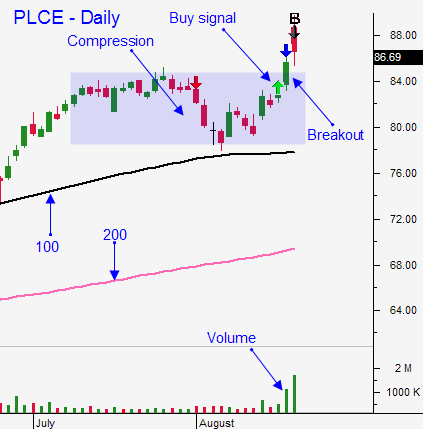

The Children's Place (PLCE) posted earnings and stock gapped through resistance on the opening bell. It pullback with the market and it compressed above the breakout on a five-minute basis. My trading system had a buy signal on the stock and the volume was high.

There are four elements that my system looks for on a swing basis. We need: a compression, a breakout through horizontal resistance, a buy signal for my trading system and heavy volume. In the chart below you can see all of these elements. Once we like the stock on a swing basis we can drill down and look for a day trading opportunity.

.

.

.

.

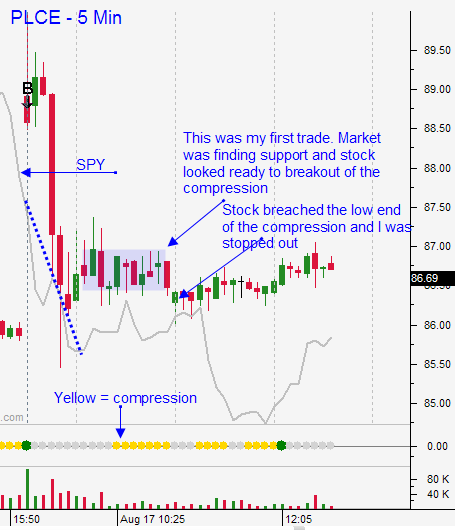

We use a five-minute chart and we look for price compressions and relative strength. In the chart below you can see that the stock was strong relative to the market right from the open. It pullback and compress early in the day. I thought it might bounce and I was ready to buy when the market stopped drifting lower. I did enter the trade at $86.75 and when the low-end of the horizontal compression failed I stopped the trade out for a $.50 loss.

.

.

.

.

We use a five-minute chart and we look for price compressions and relative strength. In the chart below you can see that the stock was strong relative to the market right from the open. It pullback and compress early in the day. I thought it might bounce and I was ready to buy when the market stopped drifting lower. I did enter the trade at $86.75 and when the low-end of the horizontal compression failed I stopped the trade out for a $.50 loss.

.

.

.

.

I have a study that shows the price action for each stock the day after they released earnings. It is a five-minute chart and you can often spot patterns. In this particular case, PLCE had a pattern of gapping, retracing and continuing the initial move. You can see this in the second chart below.

.

.

.

.

I have a study that shows the price action for each stock the day after they released earnings. It is a five-minute chart and you can often spot patterns. In this particular case, PLCE had a pattern of gapping, retracing and continuing the initial move. You can see this in the second chart below.

.

.

.

.

I knew the stock would present an excellent opportunity and based on the early rally I knew that it had fantastic upside. I waited patiently and I reentered the trade at an average price of $86.82. I was much more confident in the market later in the day and I was much more confident the stock would release. Consequently, I doubled up on my initial position.

In the final chart you can see that the stock did release and I had a limit order to sell it at $87.82. My target is fairly passive given the high of the day, but I wanted to lock in profits in this choppy market. This trade lost $.50 the first time around, but it made $2.00 (2x $1) on the second effort for a net of $1.50.

.

.

.

.

I knew the stock would present an excellent opportunity and based on the early rally I knew that it had fantastic upside. I waited patiently and I reentered the trade at an average price of $86.82. I was much more confident in the market later in the day and I was much more confident the stock would release. Consequently, I doubled up on my initial position.

In the final chart you can see that the stock did release and I had a limit order to sell it at $87.82. My target is fairly passive given the high of the day, but I wanted to lock in profits in this choppy market. This trade lost $.50 the first time around, but it made $2.00 (2x $1) on the second effort for a net of $1.50.

.

.

.

.

My trading system finds these trades and it delivers a handful of stocks each morning that we know are prime for trading. We have to be patient in this market and chat room members help each other by monitoring these compressions and breakouts. The lesson I've provided you this morning is also part of the ongoing education I provide in the chat room. My market analysis keeps us on the right side of the action.

I hope this helps you become a better trader. If you are looking for excellent trading opportunities, joint my chat room.

Look for dull trading today. Be patient and trim your size. I did not see profit-taking yesterday and that decreases the likelihood for an August pullback. The action will pick up after Labor Day.

.

.

My trading system finds these trades and it delivers a handful of stocks each morning that we know are prime for trading. We have to be patient in this market and chat room members help each other by monitoring these compressions and breakouts. The lesson I've provided you this morning is also part of the ongoing education I provide in the chat room. My market analysis keeps us on the right side of the action.

I hope this helps you become a better trader. If you are looking for excellent trading opportunities, joint my chat room.

Look for dull trading today. Be patient and trim your size. I did not see profit-taking yesterday and that decreases the likelihood for an August pullback. The action will pick up after Labor Day.

.

.

We use a five-minute chart and we look for price compressions and relative strength. In the chart below you can see that the stock was strong relative to the market right from the open. It pullback and compress early in the day. I thought it might bounce and I was ready to buy when the market stopped drifting lower. I did enter the trade at $86.75 and when the low-end of the horizontal compression failed I stopped the trade out for a $.50 loss.

.

.

.

.

We use a five-minute chart and we look for price compressions and relative strength. In the chart below you can see that the stock was strong relative to the market right from the open. It pullback and compress early in the day. I thought it might bounce and I was ready to buy when the market stopped drifting lower. I did enter the trade at $86.75 and when the low-end of the horizontal compression failed I stopped the trade out for a $.50 loss.

.

.

.

.

I have a study that shows the price action for each stock the day after they released earnings. It is a five-minute chart and you can often spot patterns. In this particular case, PLCE had a pattern of gapping, retracing and continuing the initial move. You can see this in the second chart below.

.

.

.

.

I have a study that shows the price action for each stock the day after they released earnings. It is a five-minute chart and you can often spot patterns. In this particular case, PLCE had a pattern of gapping, retracing and continuing the initial move. You can see this in the second chart below.

.

.

.

.

I knew the stock would present an excellent opportunity and based on the early rally I knew that it had fantastic upside. I waited patiently and I reentered the trade at an average price of $86.82. I was much more confident in the market later in the day and I was much more confident the stock would release. Consequently, I doubled up on my initial position.

In the final chart you can see that the stock did release and I had a limit order to sell it at $87.82. My target is fairly passive given the high of the day, but I wanted to lock in profits in this choppy market. This trade lost $.50 the first time around, but it made $2.00 (2x $1) on the second effort for a net of $1.50.

.

.

.

.

I knew the stock would present an excellent opportunity and based on the early rally I knew that it had fantastic upside. I waited patiently and I reentered the trade at an average price of $86.82. I was much more confident in the market later in the day and I was much more confident the stock would release. Consequently, I doubled up on my initial position.

In the final chart you can see that the stock did release and I had a limit order to sell it at $87.82. My target is fairly passive given the high of the day, but I wanted to lock in profits in this choppy market. This trade lost $.50 the first time around, but it made $2.00 (2x $1) on the second effort for a net of $1.50.

.

.

.

.

My trading system finds these trades and it delivers a handful of stocks each morning that we know are prime for trading. We have to be patient in this market and chat room members help each other by monitoring these compressions and breakouts. The lesson I've provided you this morning is also part of the ongoing education I provide in the chat room. My market analysis keeps us on the right side of the action.

I hope this helps you become a better trader. If you are looking for excellent trading opportunities, joint my chat room.

Look for dull trading today. Be patient and trim your size. I did not see profit-taking yesterday and that decreases the likelihood for an August pullback. The action will pick up after Labor Day.

.

.

My trading system finds these trades and it delivers a handful of stocks each morning that we know are prime for trading. We have to be patient in this market and chat room members help each other by monitoring these compressions and breakouts. The lesson I've provided you this morning is also part of the ongoing education I provide in the chat room. My market analysis keeps us on the right side of the action.

I hope this helps you become a better trader. If you are looking for excellent trading opportunities, joint my chat room.

Look for dull trading today. Be patient and trim your size. I did not see profit-taking yesterday and that decreases the likelihood for an August pullback. The action will pick up after Labor Day.Daily Bulletin Continues...