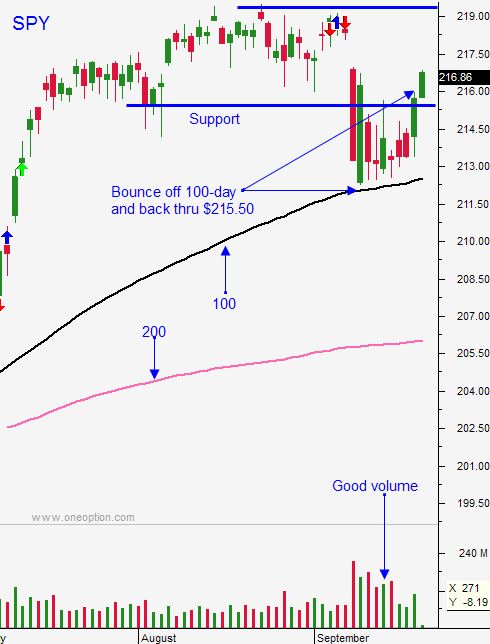

Market Will Test the Downside – 100-Day MA In Striking Distance

Posted 9:30 AM ET - Yesterday the market tested the downside and it never recovered. Support at SPY $215.50 was breached and stocks closed on the low of the day. The small bounce this morning should fade quickly as sellers test the bid.

Last week the FOMC said that a rate hike this year was likely. They won't do it before the election so they will hike in December just like they did a year ago. The Fed tempered their statement by saying that future rate hikes would be gradual. That ploy worked for a day, but traders realize that the Fed can change its mind.

If you look at the price action after the rate hike last year, you can see that the market did not like higher interest rates. Consequently, I believe we have seen the highs of the year.

The S&P 500 is only 15 points from the 100-day moving average. I believe it will be tested again. If that level fails, we will challenge the 200-day moving average.

September and October are historically weak months and I hope we see a decline in the next few weeks. If we don't, the market will chop around in a tight range and it will wait for the next news event (FOMC meetings, labor reports and the election).

I will favor the short side early today. After the first hour of trading I will take a more neutral stance. Major support is within striking distance and I believe the downside today will be relatively contained.

The presidential debate last night was fairly civil. New polls taken later this week will reveal the winner. I don't feel that either candidate made any major mistakes, but I do feel Trump missed some opportunities.

Get short near the open. Know that support is fairly close by and that the damage should be relatively contained. Set targets and take profits on your shorts. After the first hour, take a more neutral approach and look for longs with relative strength and shorts with relative weakness. We are likely to chop around today and as long as I have the pattern I trade, I really don't care which side of the market I'm on.

Support is at $212 and resistance is at $215.50.

.

.

Daily Bulletin Continues...