Buy Dips the Next Week – Mega Cap Tech Earnings Will Keep Buyers Engaged

Posted 9:30 AM ET - I hope you can attend my live trading event 2 1/2 hours after the open today. I will show you what we traded early in the day and I will explain why the trade worked.

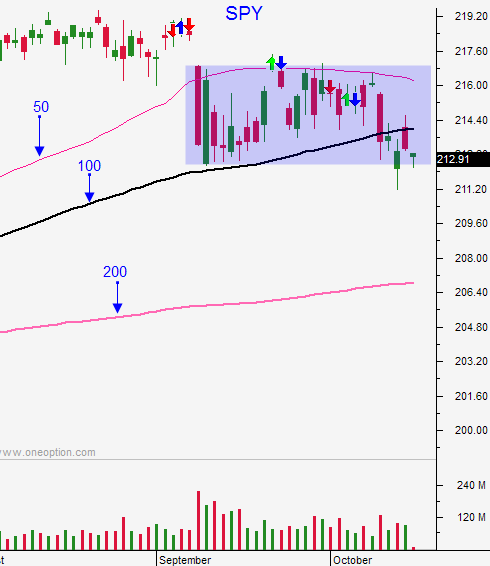

Yesterday the market staged a nice rally and we closed above the 100-day moving average. Seasonal weakness has ended and mega cap tech stocks are about to announce earnings. This will keep buyers engaged and any dip in the next week will present a buying opportunity.

Microsoft posts results after the close today and the stock is coiled. A breakout either way could lead to a sustained move. Results have been good this year and I'm expecting a friendly number.

Down opens have been very profitable for us. I will be looking for stocks to buy once the market finds support this morning. The SPY has been chopping around the 100-day moving average and we will poke below it on the open. When we rally back above it I will get long and I will lean on that support level (if we fall below it exit longs and re-enter when we are back above it).

Trading activity slows down dramatically after the first few hours. That means you need to exercise greater patience later in the day. I suggest waiting for pullbacks on strong stocks and buying them once support is established. Set passive targets and know that you won't have a market tailwind to fuel the move. I prefer this strategy to buying breakouts to a new high of the day. Those moves are often head fakes and the stocks pullback sharply when the breakout fails.

The economic releases are pretty light and earnings are the focal point.

Look for opportunities to get long this morning. While the market probes for support I will be looking for stocks that have relative strength. I'm expecting us to close above the 100-day moving average today.

.

.

Daily Bulletin Continues...