Best Way To Buy Calls Ahead Of Earnings – Follow My Advice

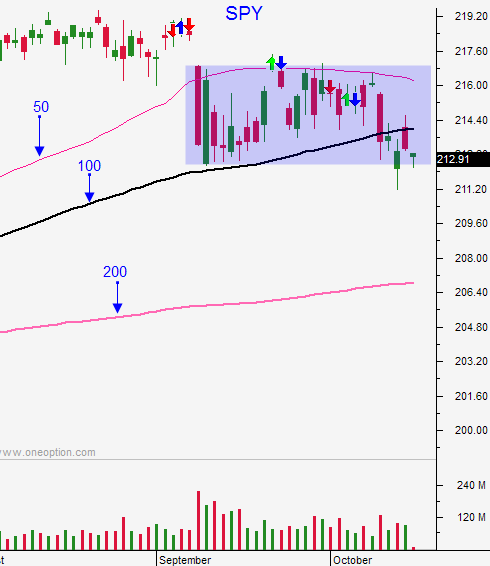

Posted 9:40 AM ET - The market is poised to rally this morning and it should get back above the 100-day moving average. European flash PMI's were better-than-expected and M&A is hot. More importantly, mega cap tech stocks are on deck and that will keep buyers engaged.

Apple announces earnings after the close Tuesday. Google and Amazon will post earnings after the close Thursday. Do you want to buy calls on these stocks? This is probably the most widely followed trade by novice option traders. Option implied volatilities are juiced and this strategy can lose money even if the stock goes higher.

My suggestion to those of you who are tempted by this play is to go to Vegas. You'll have much more fun and your odds success will be better.

We trade before earnings and after earnings. We never hold over the number.

I've spent my career trying to get my winning percentage above 80% and I can find these trades all day long (non-earnings trades).

Earnings plays are a 50-50 proposition and I've spent over a decade trying to find/develop an indicator with predictive power. My conclusion is that the moves are random.

I can't tell you how many times I've been long calls and the number has come out gangbuster. With great anticipation I wait for the reaction and the stock drops. Why would the stock fall after beating estimates by a landslide? Sometimes great expectations are already baked into the stock. Sometimes the guidance is little soft. Sometimes there are simply too many retail bets on one side of the trade and large institutions push the stock down temporarily.

Option implied volatilities are sky-high before the number and I urge you not to buy puts/calls with the intent of holding over the number. Your probability of success is less than 30%.

The market should have a good week and if we close above SPY $214 we can lean on the 100-day moving average. Day trade from the long side and consider holding a few longs overnight this week.

Credit spreader's can sell out of the money November bullish put spreads. This is an excellent opportunity to take advantage of quiet trading and a market bounce off of the low-end of the range. Make sure that technical support lies between the short strike price and the stock price. If the stock breaks technical support, buy back the spread. Also, if the SPY falls back below the 100-day moving average consider buying back the spread.

At a forward PE of 17, stocks are not cheap. Earnings will be good, but not strong enough to push us to an all-time high when a rate hike is looming.

.

.

Daily Bulletin Continues...