FOMC Today – Any Surprise Favors the Downside

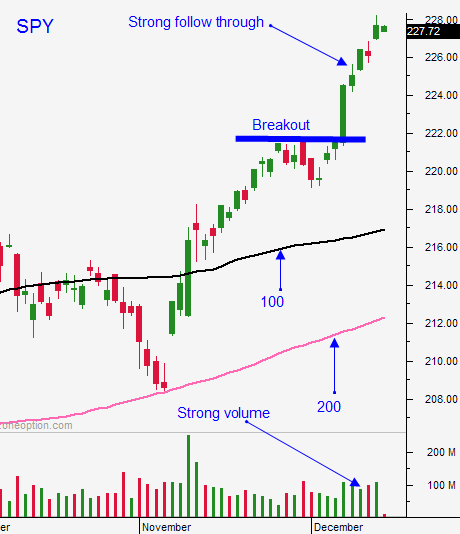

Posted 9:30 AM ET - Yesterday the market was strong the entire session and it closed on the high the day. The momentum clearly points higher.

All eyes will be watching the FOMC statement this afternoon. A rate hike is priced in and so are dovish comments. I believe the Fed will point to the back half of 2017 for the next rate hike because they want the transfer of power to go smoothly. Normally, this rhetoric would have sparked another leg higher. Because we've rallied so hard in the last week I believe the upside is relatively contained and this news would simply allow the market to tread water. Without question, any surprise favors the downside.

If the Fed hints that economic growth is accelerating and that they remain flexible, the market will retreat. A rate hike in the first half of 2017 (or the possibility of it) would spook investors.

Keep in mind that this is a legitimate market breakout and that any dip greater than 30 S&P points will represent a buying opportunity.

I don't plan on trading after the announcement today. If the market rallies, I don't want to chase stocks at an all-time high. If the market retreats, I don't want to go against the trend. I will let the market come in and I will prepare to buy once support is established.

Keep your size and your trade count down this morning. The range will be fairly tight and the volume will drop off after the first two hours.

Our best scenario is a negative reaction to the FOMC statement. That will present us with an excellent buying opportunity once the dust settles.

.

.

Daily Bulletin Continues...