Market Will Probe For Support Today – Fed Comments Were Hawkish

Posted 9:30 AM ET - Yesterday the market sold off after a hawkish FOMC statement. The Fed expects three rate hikes in 2017 and that is up from to rate hikes. Janet Yellen said that economic growth is improving at a nice pace and that inflation could get to 2% by 2018. As I mentioned in my comments yesterday, any surprise would favor the downside.

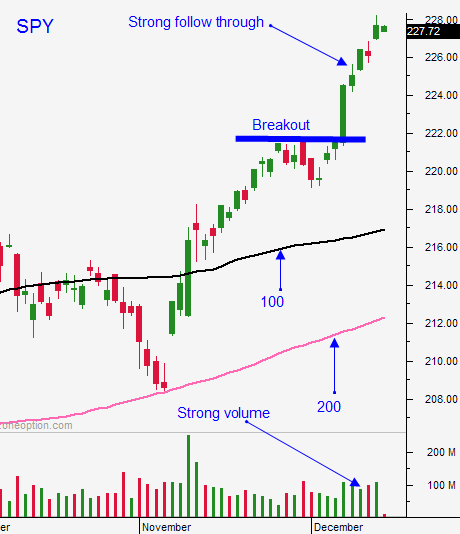

Stocks held firm after the announcement, but selling quickly surfaced and support at SPY $227 was breached. There were a number of 10 point S&P swings yesterday and that is a sign of two-sided price action.

The downside will be tested this morning. Buyers will pull bids so that they can gauge the selling pressure and we will see some profit-taking. Bullish speculators will also get flushed out on this move. Any decline of more than 30 S&P points will represent a buying opportunity.

It is critical to let this wave of selling run its course and it could last a few days.

Interest rates are at historic lows and a tiny quarter-point rate hike should not spoil the party. Lower corporate tax rates and reduced business regulation will fuel profits. A repatriation "holiday" could bring a few trillion dollars back into the United States. Trump has also proposed a big fiscal spending plan.

The backdrop is very bullish and seasonal strength will keep buyers engaged.

We needed a market decline and we should get one in the next two days. Tech stocks looked good yesterday and we should see a rotation back into those names.

Emerging markets will be very weak and I like EDZ and BZQ. Gold is also bearish.

There really isn't much market support until SPY $221.50.

Look for an early round of selling. I will not try the long side until I see a nice drop this morning. I also want to see a higher low before I start nibbling.

If the market is below the first hour low after two hours of trading, we are likely to drift lower.

Day traders need to be flexible and look for trades on both sides (focus on the short side early). Swing traders be patient and wait for support. An excellent buying opportunity will surface soon.

.

.

Daily Bulletin Continues...