Quiet Market Ahead – Focus On “Fresh” Stocks and Set Targets

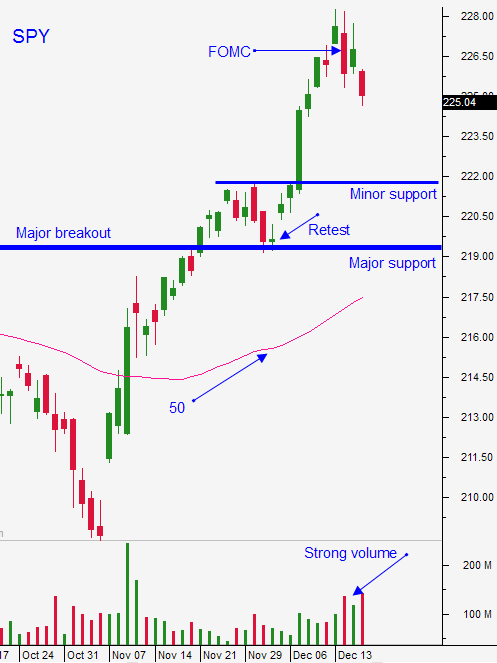

Posted 9:30 AM ET - The market is likely to float higher on seasonal strength. It was able to shoulder a hawkish FOMC statement and it is likely to float higher on seasonal strength.

There is not much to stand in the way of this rally and trading volumes will decline sharply as the week progresses. Even a small bid can push stocks higher.

I am noticing wider bid/ask spreads and that also makes it tougher to day trade.

I want to trade from the long side, but up opens are challenging. It is much tougher to identify stocks with relative strength and it's hard to tell if the early market rally will hold. Consequently, I will sit out the first 30 minutes of trading.

As the day progresses, news is priced in and stocks that had nice momentum stall. The opportunities decline after the first few hours and I don't plan on trading the afternoon session.

I am focusing on "fresh" news. Stocks that were up yesterday are down today and I have removed old stocks from my watch list (I don't want to be tempted). In order for a stock to make a sustained move it needs news today or a significant breakout on heavy volume. There is a price discovery phase and that is what I am trying to take advantage of. It quickly runs its course. Once it's over, it's over.

Know that you won't have much of a market tailwind this week. I'm expecting the S&P 500 to stay in a relatively tight range.

Focus on "fresh" plays and set targets. Trim your size and your trade count. Make your money early and try to find a few good trades. If you happen to catch a couple of nice winners early, consider calling it a day.

Low-volume markets are very difficult to trade. Don't piss your trading capital away in this low probability environment.

.

.

Daily Bulletin Continues...