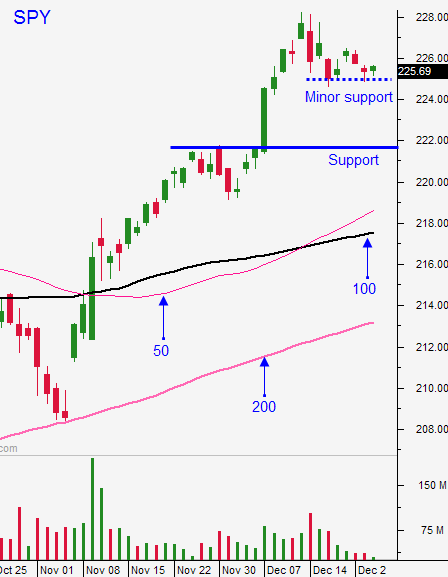

Market Will Test the Downside Early – Minor Support At SPY $225 Was Breached

Posted 9:30 AM ET - Yesterday we saw steady profit-taking and the market closed below a minor horizontal support at SPY $225. Tech stocks were particularly weak and we could see more selling today. In my comments Wednesday I told you the market was vulnerable to profit taking.

Buyers will be cautious with stocks near their all-time high. Trading volumes are extremely light and portfolio managers are "window dressing" for year-end.

Gold started to move off of a base and precious metals could gain traction.

This is a very low probability environment for day trading. Bid/ask spreads are a mile wide and a small institutional trade of 30,000 shares or less can impact some stocks. Keep your powder dry the next few days and prepare for a busy 2017.

We did see a steady directional move yesterday, but that was the first of its kind in more than a week. Typically the market has chopped back-and-forth during these holiday sessions.

Yesterday I mentioned that the higher open was a trap. I noticed Tuesday that every stock that gapped higher faded the entire day. This is bearish price action and we saw similar yesterday. We will probably see the same this morning. The early rally will fade quickly and the downside will be tested.

I don't plan on trading today. If you decide to trade, favor the short side early. If we continue to drift lower after the first hour of trading you can stick with the short side (we are below SPY $225). If you favor the long side, make sure the SPY is above $225 and use that as your stop.

This pullback will present an excellent buying opportunity next week. Support needs to be established. Be patient and let the market "come in".

.

.

Daily Bulletin Continues...