Buy More Calls If the SPY Closes Above $230

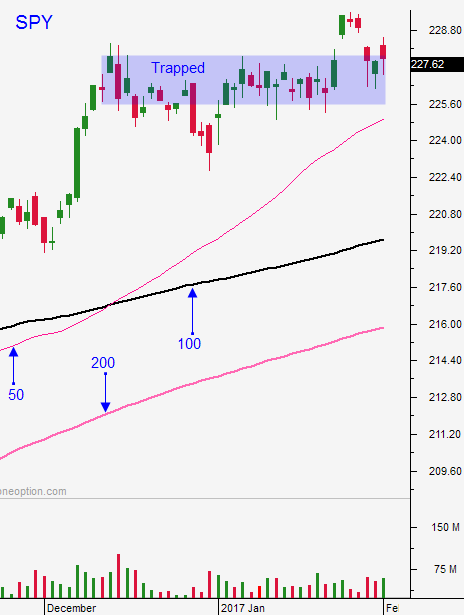

Posted 9:00 AM ET - The market staged a strong rally the first two hours of trading last Friday and then it flat lined. Since then, the action has been choppy. The S&P 500 was down a little yesterday and this morning we will make all of that back. We are within striking distance of the all-time high and we need to test it in the next day or two. If we make a new high today, add to your call positions.

In the last two weeks we've broken out to a new high and we’ve tested the breakout. This retest is common and we can get long with confidence than before (the breakout has been validated).

Earnings season has been decent, global economic conditions are improving and the Fed statement last week was dovish. The backdrop is good for a breakout.

I want to see the SPY above $230 with follow through the next two days. I also want to see buying into the close.

Swing traders should have some call positions on already. If the market makes a new all-time high today, add to positions. If the market closes above the all-time high, add to the positions.

The breakout needs to happen in the next two days or the probability of a sustained rally starts to dwindle.

Day traders lineup your longs early in the day and be prepared to act in the first 30 minutes. The S&P 500 is only a few points away from the all-time high so it can come quickly. I will trade from the long side early in the day. I want to see volume on the stocks I'm trading.

A grind higher through the all-time high and a finish above SPY $230 today would be very bullish.

A grind higher and a stall at $230 is possible. The market could inch its way through resistance this week.

A close below SPY $228.60 would be bearish.

.

.

Daily Bulletin Continues...