Market Wants To Rally – Smooth Sailing Until You See This Pattern

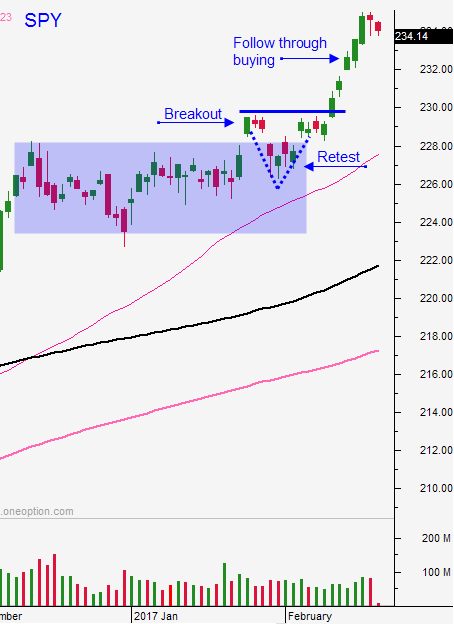

Posted 9:00 AM ET - Last week the market inched its way to a new all-time high. We saw follow through buying after the retest of the breakout and the price action this morning points higher. I believe we will have a bullish week.

I mentioned a few days ago that I am not worried about down opens. Those are natural in a bull market. Typically the market will rally into the close and finish on the high of the day. The market will get a little over-extended and some of the fluff will come out the next morning (profit taking). Once the morning weakness has run its course buyers step in and we repeat the pattern. That is why these runs have sequential green candles on a chart (lower open and higher close).

A big gap higher (more than 15 S&P points) is something we need to watch for. Shorts will scramble to cover and bullish speculators will pile in. An early high with a reversal will flush them out and this price action would mark a short term top. I still believe we have a way to go before we see that.

Europe’s flash PMI was good and global markets have a bid this morning.

The market will nurse a hangover after a 3-day weekend. I am expecting a pretty quiet day. Earnings season is winding down and the economic calendar is pretty light.

Swing traders should be long calls. We raised our stop on the SPY last week to $233 and that support held. Keep moving your stops up when possible.

Day traders need to be patient. Let the day unfold and make sure that this early rally holds. I am going to sit out the first hour of trading. I have been finding better trades mid-morning. After a couple of hours I also have a better feel for the market.

As the market rally matures I am seeing a log of stocks that are struggling to move higher. Many burst out of the gates with impressive rallies early in the day and the move reverses. These head fakes can be nasty and I encourage you to be very patient on the open. Let the stock prove that it is the real deal.

Look for a quiet day with stable price action.

.

.

Daily Bulletin Continues...