March Madness – Market Surges Higher On Trump Speech – Take Profits

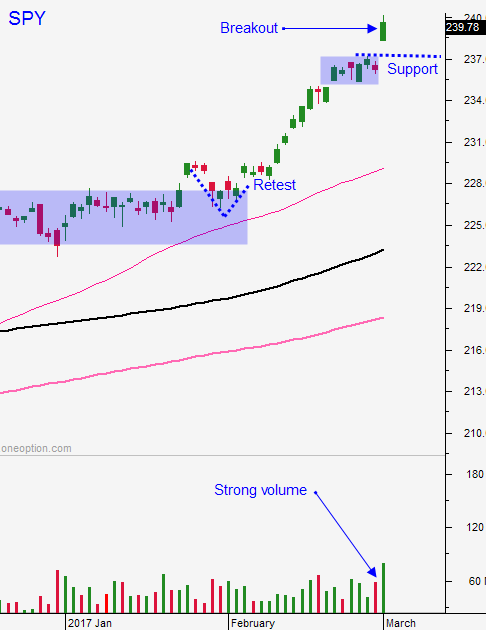

Posted 9:00 AM ET - Any doubt on whether the market has broken out of its range was put to rest yesterday. Stocks shot higher yesterday on Trump's well-received speech before Congress. The market opened higher, paused briefly and then staged the next leg of its rally. We needed to be careful early on because a reversal would have been bearish. As it turns out, buyers are lined up and the market has room to run.

I was looking for bullish price action the rest of the week, but after move like that we might pause for a bit. The market needs to consolidate these gains and the headwinds will start blowing as the FOMC meeting approaches.

It looks very likely that the Fed will hike rates in March. Many officials are saying as much and analysts have the probability at 80%. A second rate increase in just three months will spook some investors. We've only seen two rate increases in the last three years and this is fairly aggressive.

Global economic conditions are improving. China's PMI came in better than expected and its GDP could grow 6.6% this year. ISM manufacturing came in at 57.7 and that is incredibly strong. We will get ISM services tomorrow. As long as domestic economic growth is strong, the market will shoulder the rate hike. Unfortunately, analysts are not seeing any pick-up on consumption and Q1 GDP forecasts have been lowered by more than .5% (JP Morgan and Atlanta Fed).

Trump is being given the benefit of the doubt, but now he has to execute.

Good news is priced in and the trend still points higher.

If you took profits on your swing trades yesterday you rested well. Most of the gains took place in the first hour of trading and now your remaining profits will be easier to manage.

Swing traders should start setting targets. The last leg of this rally will be hard-fought. I also suggest moving your market stop up to SPY $238 on a closing basis. This is been a good run and we need to protect profits.

Day traders should look for early weakness and support. Much of the fireworks are over and the action should quiet down. We saw late day selling yesterday and that is a sign of profit-taking. After an early probe lower, we should try the upside. I don't believe we will get much above the high from yesterday and we might not even challenge it. There should be good opportunities on both sides today.

Financials are my favorite longs here.

This has been a fantastic run. Squeeze what you can out of your remaining positions and head for the sidelines.

The nice thing about huge market moves is that they set up lots of trading opportunities (up and down) later in the year.

.

.

Daily Bulletin Continues...