Don’t Trust the Weak Jobs Report – Fed Is Going To Hike In 2 Weeks

I JUST POSTED 3 NEW DAY TRADING VIDEOS WITH 2 HOURS OF LIVE TRADING

Posted 9:30 AM ET - The videos are right at the top of the Tutorial page. I selected the stocks and then I traded them Thursday. See how I did.

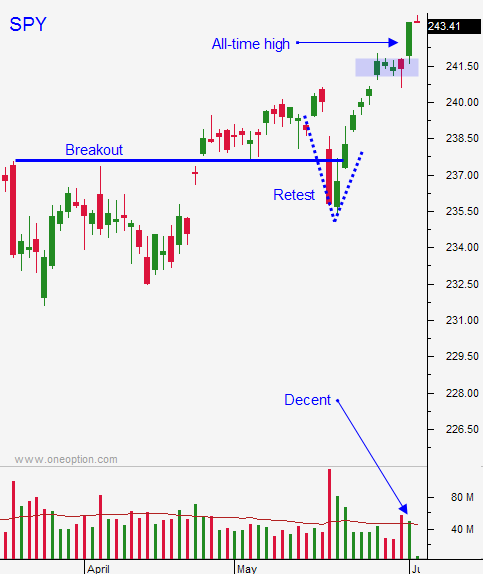

Yesterday the market staged a nice rally on the heels of a strong ADP report. The momentum was steady and the volume was fair (reached the 20-day average). Day traders can join the breakout, but I suggest keeping overnight long positions to a minimum. The downside risks far outweigh the upside rewards for swing traders.

ADP reported that 253,000 new jobs were created in the private sector during the month of May. I trust this number and I do not trust the government's number. ADP processes payrolls for small and medium-size businesses and they know how many paychecks were cut. The government relies on claims from unemployment offices. Garbage in - garbage out. This number is filled with seasonal adjustments and it relies on accurate information from all of the offices (horrible around the holidays).

This morning the jobs report came in very light. Only 138,000 new jobs were created in May. This goes against the declining initial claims reports for the last two months and it is contrary to the ADP report. For anyone who trusts the BLS (Bureau of Labor Statistics) this is very bearish news.

The market has shouldered a bad number. That tells me that traders don't trust the BLS figure either.

The Fed is going to hike rates in two weeks and we need strong employment. Once they tighten every subsequent data point needs to be strong. Don't for a second think that this dismal jobs number is going to postpone a rate hike.

ISM manufacturing was decent yesterday. Global PMI's were a little soft this week. Economic growth seems to be moderating.

Politicians will take time off and tax cuts will be delayed. Investors will grow impatient towards the end of summer.

Swing traders should stay in cash. Option implied volatilities are miniscule and it doesn't make sense to sell bullish put spreads at this level. One little market pullback and you'll be in trouble.

Day traders can take advantage of the breakout. Favor the long side and use SPY $241.50 as your guide. As long as we are above it you can favor the long side. Be careful on the open today. This was a soft number. Energy and financials are down before the open. This early rally could easily vaporize and the market will probe for support. Once support is established a good entry point for longs will surface.

Favor the long side today and keep overnights to a minimum.

.

.

Daily Bulletin Continues...