Market Ignores Dismal Jobs Report – Rate Hike Will Keep A Lid On the Rally

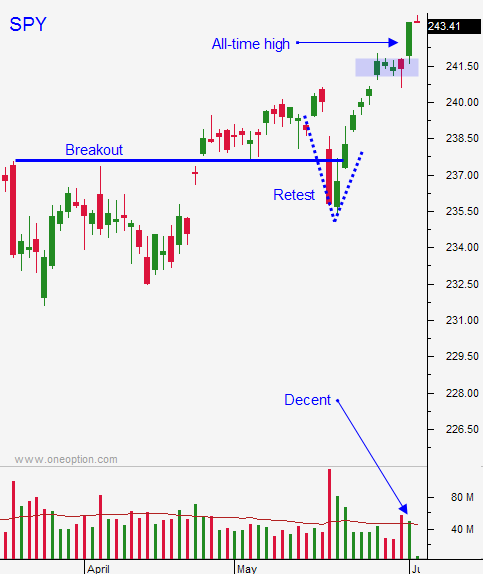

Posted 9:20 AM ET - Last week the market staged a nice breakout on good volume. The path of least resistance points higher, but I'm skeptical. Energy and financials have not participated in the rally. I am day trading from the long side and I'm keeping my overnights to a minimum. If this breakout holds through the FOMC next week, I will start taking some overnight bullish positions.

Friday's jobs report was dismal and it runs contrary to initial jobless claims and the ADP report. Traders didn't put much weight in the number and the market marched higher. On a longer-term basis we need to see consistent job growth above 250,000.

ISM services will be posted this morning and it's an important number since 75% of our economic growth is tied to the services sector. ISM manufacturing was decent last week.

The Fed will raise rates next week. Any economic soft patch after that will be met with profit-taking. "Good news is good news" and we need strong numbers to justify a third rate hike in six months.

Politicians will take the summer off and there will NOT be any progress on health care/tax reform.

Swing traders need to stay in cash through the FOMC meeting. I believe we could see some profit-taking before that and there's a chance that the reaction will be negative. If the market can hold recent gains after the rate hike, we can start scaling into long positions.

Day traders can take advantage of this breakout. Try to get long early this morning. Set passive targets and use SPY $243 as your guide. That was the low from Friday and as long as we are above it you can favor the long side.

Bullish markets tend to open on the low and close on the high. Oil is down and financials are flat. There is not much of a tailwind this morning. After a nice run the last two days, the market is due to take a breather today.

Any sign of late day selling and follow through the next morning will be bearish. Watch for profit-taking.

.

.

Daily Bulletin Continues...