Market Is In A Holding Pattern Until FOMC Wed – Watch Financials

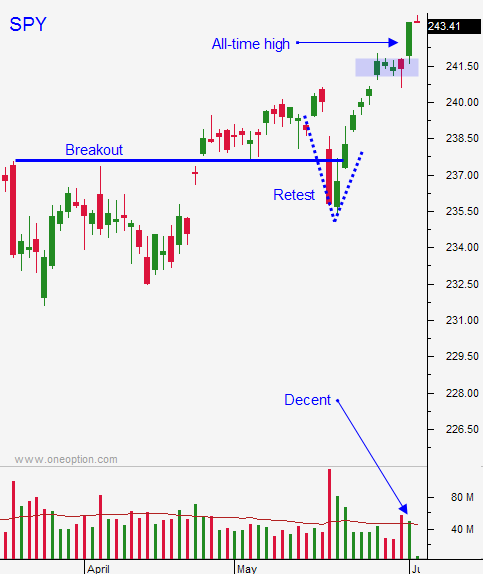

Posted 9:00 AM ET - The market is in a holding pattern until the FOMC next week. Trading volumes are light and the daily range is extremely tight.

Economic growth is moderating and any stumble will be met with profit-taking after the Fed raises rates.

Swing traders should stay in cash. If the market is able to shoulder the rate hike and hold the breakout I will passively consider overnight longs. The downside risks are greater than the upside rewards so I will error on the side of caution.

I would welcome a pullback to the 100-day moving average, but that might not happen until August. Politicians will take time off this summer and investors will grow impatient with "the swamp". We need a rate hike and an economic soft patch for that to occur.

Day traders need to focus on a couple of good trades each day. Keep your size small and set passive targets. The S&P 500 has been trapped in a tight three-point range after the open. If the market can breakout of the first hour range favor that side. Support is at SPY $243. I have been looking for strong stocks that pull back on the open. Once they find support I scale in and I use the low of the day as my stop.

Financials had a decent bid yesterday. As long as this sector is on the plus side the market should be able to tread water or move higher. Use the XLF as your guide.

It is going to be a quiet day.

.

Daily Bulletin Continues...