Rate Hike Today – Fed Will Make Dovish Comments – Market Will Advance

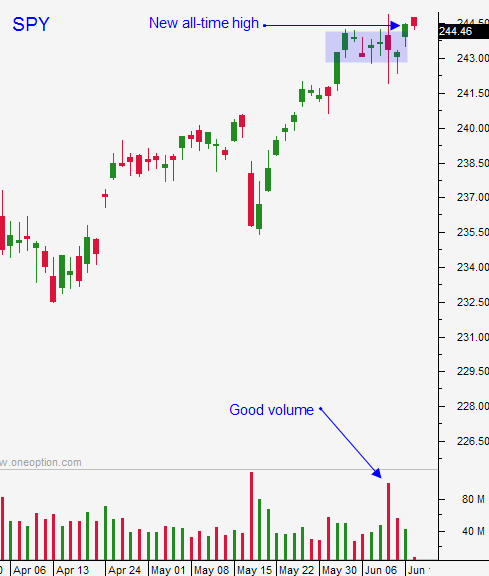

Posted 9:30 AM ET - Yesterday the market staged an impressive rally and it closed at a new all-time high. Tech stocks rebounded and they look strong this morning. The Fed will hike rates later today and investors are prepared.

Economic growth is moderating and that should come through in the FOMC statement. The Fed will soften the blow with dovish rhetoric and the market will like it. In a couple of months they will start to ratchet up the tone and we can expect another hike this year (December).

The market has a tendency to decline ahead of the FOMC and to rally afterwards. I'm seeing rotation into other sectors and that is a healthy sign. Tech will participate but it will not lead to the extent that it did a few weeks ago.

China's industrial production and retail sales were in line.

The news will dry up after the FOMC statement and the summer doldrums will set in.

Swing traders should sell out of the money bullish put spreads on strong stocks. Make sure that technical support lies between the stock price and the short strike price. If technical support is breached, buy back the put spread. You can also use SPY $242 as a market stop. Don't miss this opportunity. Option implied volatilities on tech stocks are fairly rich and you can take advantage of time decay and a collapse in option premiums.

Day traders should take it easy ahead of the Fed. I'm not going to buy into this early rally. Stocks will get overextended and the market will stall. Many of the early "runners" will retrace and then we will be "dead till the Fed". After the FOMC statement I will wait for 15 minutes and I will follow the direction that is established. If the market just chops around I will keep my trading to a minimum.

Quadruple witching is Friday and the indices will be rebalanced. We can expect more sector rotation in the next week. We should also see one big day of movement before expiration.

Look for brisk trading conditions Thursday and Friday. Don't miss your opportunity to sell some out of the money bullish put spreads.

.

.

Daily Bulletin Continues...