Market Comfortable With Fed Rate Hike – Sell Bullish Put Spreads

SAVE 50% ON OPTION CHAT THROUGH SUNDAY

I am currently running my Deal of the Year and it ends Sunday (Father's Day). Option Chat is only $599.95 for the year and this is 50% off of the normal price. You will get new options trades each week and daily follow up. Exact entry and exit (stop and target) are provided with extensive research. All of the trades are posted before the open and you will NEVER MISS A TRADE. The website is mobile friendly so you can view it on your cell phone. We've had a great year and I hope you join us.

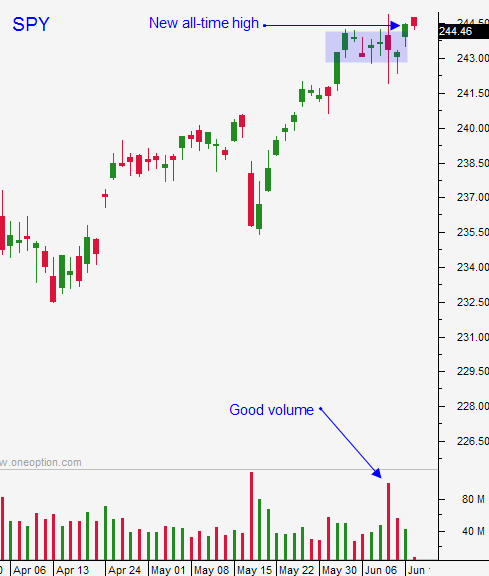

Posted 9:30 AM ET - This week the Fed raised rates and their comments were little more hawkish than expected. Stocks pulled back yesterday and they instantly found support. By the end of the day most of the losses were erased. This bodes well for the market.

The news is light and the summer doldrums will set in. I've been urging you to sell out of the money bullish put spreads and I hope you sold some yesterday. Add to positions today and look for a small grind higher.

Swing traders don't miss this opportunity. Option implied volatilities are a little elevated and this will be your best chance. Make sure that technical support rests between the short strike price and the stock price. If technical support is breached, buy back your put spreads. Market support is at $243, $242 and $240. Trading ranges will contract and the volume will decline.

Day traders should look for opportunities to get long on any pullback. Yesterday I told you that I was not interested in trading the short side. My focus was on the long side and the low was established in the first hour of trading. After that the market marched higher. The bid is still strong and buyers were not deterred by the latest round of tightening.

This is a bull market and it is foolish to "pick tops". From a day trading standpoint I am almost to the point where I won't trade on days when the market opens more than five S&P points higher. Stocks look great early in the day and it's hard to identify relative strength. Once the dust settles stocks pullback and then they flat line. It's just not worth trading when market conditions are in this pattern. Shorting into those rallies is extremely difficult and your risk is elevated because you're on the wrong side of the market. I love down opens and I am active on those days once support is established. Flat opens are OK if the market can get above the first hour high.

The game plan for the next few weeks is to day trade when the market opens in negative territory and to have some bullish put spreads on to generate income.

Earnings season starts in a few weeks and buyers will remain engaged.

Economic conditions are stable and the market is comfortable with the recent rate hike. Politicians will take time off and the headlines will be benign.

Look for opportunities to sell bullish put spreads and buy dips. This is a quadruple witch and the price action will be a little choppy today.

.

.

Daily Bulletin Continues...