Fed Very Hawkish – Investors Are Worried

Posted 9:00 AM ET - Yesterday the market rebounded after an extended holiday and tech stocks led the way. Conditions are still very shaky and the FOMC minutes are taking a toll this morning. Investors are concerned that the Fed is moving too quickly and that moderate economic growth does not justify another rate hike.

ADP reported that 158,000 new jobs were created in the private sector during the month of June. This is well below estimates.

Politicians are in recess and the healthcare bill is in limbo. Tax cuts and tax reform are on the back burner and we won't see any progress for months.

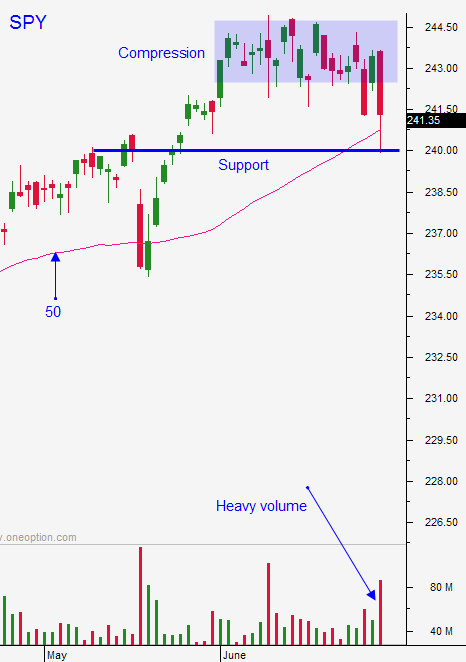

Earnings season will eventually attract buyers, but major support will be tested at SPY $240 and QQQ $135.

Swing traders should buy back bullish put spreads if stocks breach key technical support levels (or if the SPY closes below $240). These stock support levels by design should be above the short strike price so you should still be out of the money. Time premium has whittled away at the positions. I don't like the current risk profile so I suggest closing the trades. Once support is tested and the market bounces we will have opportunities to reestablish bullish put spreads. This bottoming process might take another week.

Day traders should prepare for negative price action today. If the market takes out the low from Thursday (SPY $240) we will see a heavy wave of selling. I am less concerned with a sustained "drip" lower during most of the day. Those moves tend to produce a late bounce that erases most of the losses. The more dangerous scenario is a sharp drop on the open and a rebound the next two hours. Once that bounce stalls the selling resurfaces and the market takes out the low of the day. This type of move can spark heavy selling late in the day with a close below major support. If this scenario unfolds we will see a down open on Friday.

Day traders need to use the patterns I outlined as a guide. If we see immediate sharp drop down to SPY $240, I will look for buying opportunities. I will set passive targets and I will be out of my long positions when the bounce stalls. Then I will shift gears and look for shorts. If the market drifts lower all morning I will favor the short side and I will buy a late bounce.

The Fed is ignoring economic growth and low inflation. This is a sign that they plan to tighten regardless of macro conditions. A market correction would force them to reconsider and I believe we will see one in August/September.

We don't need to look that far ahead. This round of profit-taking will last another week and earnings season will attract buyers.

Resistance is at SPY $242 and $243 and QQQ $138 and $139.50.

.

.

Daily Bulletin Continues...