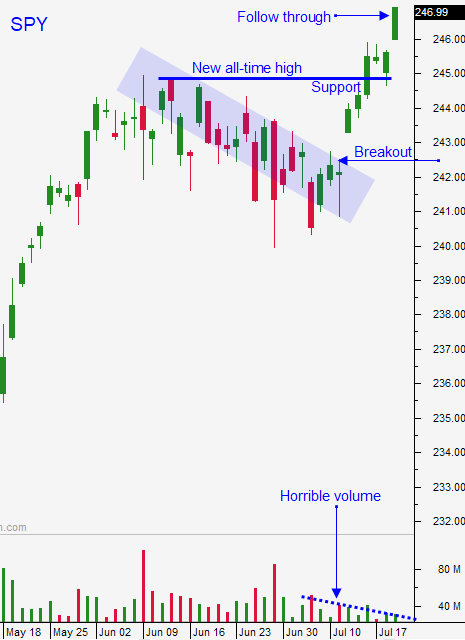

Market Rally Will Stall Soon – Raise Stops and Take Profits

Posted 9:25 AM ET - Yesterday the market gapped up on the open and it continued to march higher right into the close. The QQQ also made a new all-time closing high. Mega cap tech stocks have been strong and they will start posting earnings. This push higher should last the rest of the week, but investors will get nervous into the FOMC meeting next Wednesday.

Earnings announcements will start cranking up and Microsoft reports after the close today. Google will post results Monday after the close and Facebook reports on Wednesday.

The Fed wants to hike rates and they will not mince words next Wednesday. Given the recent market rally, I'm expecting fairly hawkish rhetoric with a December timeline for the next round of tightening.

Politicians continue to muddle around, but this won't dampen spirits for another month. A lack of progress will become a concern in September and the debt ceiling will loom. Without a healthcare bill expenses are escalating and it would be a mistake to try and tackle tax reform. Again, this is not a concern for the next few weeks.

Swing traders should be long QQQ calls. Raise your stop to QQQ $143.50 on a closing basis. That was the prior all-time high and we can lean on it. Start buying back your bullish put spreads for $.05. Chances are they have "maxed out". Take profits, reduce risk and release margin. After earnings announcements there will be an opportunity to selectively sell out of the money bullish put spreads on stocks that have reported strong results.

Day traders need to tread cautiously on the open. Once the bid has been tested start scaling into long positions. After a nice run, we should expect a dip along the way. The selling will be brief and these pullbacks will be excellent entry points. Use the first hour high as your guide. If we are above it you can get more aggressive and use that level as your stop. Momentum will carry the market higher.

Once mega cap tech stocks have reported the market will stall. Good news will be priced in and we should see profit-taking towards the back half of August. This has been a light volume rally.

Stay long and trail your stops higher with the market. Buy back bullish put spreads and lock-in profits if they have "maxed out".

Support is at SPY $245.60.

.

.

Daily Bulletin Continues...