New Market High In A Few Days – Hawkish Fed Did Not Spark Profit Taking

Posted 9:30 AM ET - Yesterday the Fed said that they plan to hike rates four times in 2018 and four times in 2019. This is more than analysts expected (total of six times) and the market drifted lower after the statement. The bid is strong and stocks rallied back into positive territory before the closing bell. This is a bullish sign and we should see a gradual move higher next week.

The FOMC statement was keeping a lid on the rally and now that it is behind us, bullish momentum will take over.

We can expect to see a few nervous jitters in the next day or two. Watch for lower opens and higher closes.

As I've been mentioning in my comments the macro backdrop is bullish. Global credit conditions are improving, economic growth is stable, earnings have been excellent and traders are ignoring missile tests in North Korea.

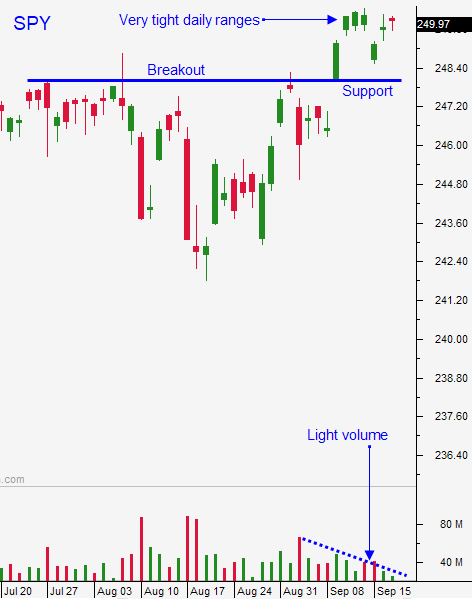

Swing traders should stay long calls and they should use SPY $248 as a stop on a closing basis. Buy November options to reduce your exposure to time decay. Also consider selling a few out of the money bullish put spreads.

Day traders should let the market probe for support today. There could be some nervous jitters after a hawkish FOMC statement. Once support is established, start scaling into long positions.

The market lacks a "driver". Trading volume will be light and the daily ranges have been compressed. Until the market makes a new all-time high, keep your trade count down. Set passive targets and take profits along the way.

I prefer to trade down opens. Relative strength is easier to spot and dips provide a good entry point.

Support is at SPY $248 and resistance is at $250

.

.

Daily Bulletin Continues...