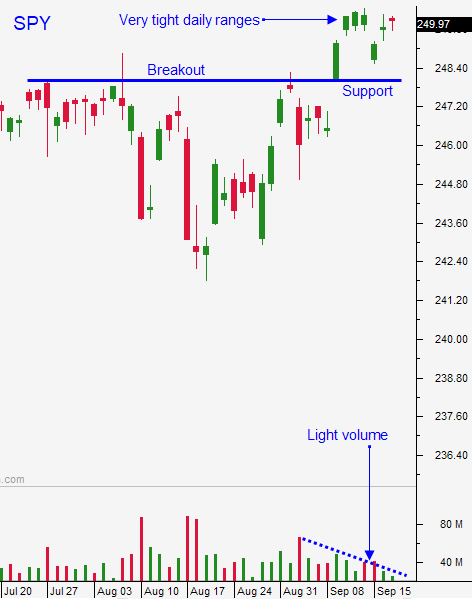

The Tighter the Range the Bigger the Breakout – Use SPY $248 As A Guide

Posted 9:30 AM ET - The market is trying to hold onto the breakout from two weeks ago. Stocks are trading in a tight range and the S&P 500 is waiting for a catalyst. As long as the SPY is above $248 I will trade from the long side.

Investors are not worried about a December rate hike or missile tests in North Korea. These events did not spark profit-taking and the bid is strong.

Economic conditions are stable and growth is moderate.

Earnings have been excellent and the guidance is as good as we've seen in years.

The debt ceiling has been extended and Republicans are working on tax cuts. Any progress (or rumors of a deal) will push stocks higher.

Swing traders should be long calls. Use SPY $248 as your stop on a closing basis. When the market breaks out to a new high you can add to positions.

Day traders need to let the market come in this morning. We have seen lower opens and higher closes. Try to make your money early in the day and set passive targets. Last week the S&P 500 was trapped in tight intraday ranges after the first hour of trading. It's hard to make money day trading when the S&P 500 has a two-point range.

Please tight compressions lead to big moves.

Stay long and use SPY $248 as your guide.

.

.

Daily Bulletin Continues...