Market Speed Bump – Try To Stay In Your Call Positions

Posted 9:30 AM ET - I was just getting started in the business 30 years ago and the bottom fell out of the market (Black Monday). I couldn't truly appreciate what was happening for a few years, but it was an incredible moment.

The drop today doesn't surprise me, I've been expecting it. We didn't know what the catalyst would be and Catalonia (Spanish province) is taking the blame. Bullish sentiment is running high and it needs to be kept in check. Speculators will get flushed out of positions today.

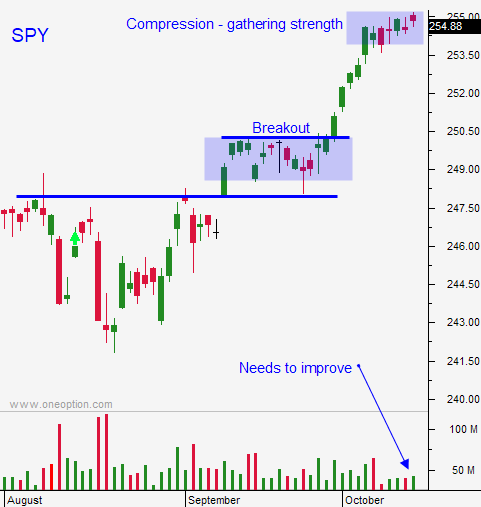

This dip will be brief and shallow. It will set up a very nice buying opportunity and it could even reverse today. First, we need to see a deep trough. It needs to create a little panic. SPY $253.50 is the first support level. Let the market come in. Asset Managers will pull bids early in the day so they can gauge profit-taking. Once the initial wave of selling has exhausted itself the bid will gradually return.

Catalonia has threatening to secede from Spain. This is not new, but the Spanish government is flexing its muscle. Previously it was hoping that the protests would subside and disappear. Spain has a very high unemployment rate (20%) and credit concerns have been fairly low to this point. Portugal's credit rating was raised a month ago and I don't see Catalonia as a major market threat.

The selling was going to come from somewhere. I've been mentioning this the last few weeks and I outlined some potential sources. From our perspective we just need to weather this speed bump.

Swing traders should have a full position of calls at this time. If you got room to add, do it once support is established.

Earnings season will fuel this rally and the prospect of a tax cut will keep buyers engaged. Earnings season is just starting to crank up and the results will be excellent. The market is only up 4% since robust guidance was given in July. I don't believe that valuations are out of line at this level.

Day traders can jump into action this morning. Don't take this first wave of selling lightly. Let it run its course and buy futures when a higher low is established. Use the prior low of the day as your stop. If the market makes a new low after two hours of trading keep your powder dry. This would be a sign that we have more downside.

This selling should run its course today, but it could take a couple of days if it gains traction. Look for support and a rebound that takes us to a new all-time high.

If the SPY closes below $253.50 you can stop out of long positions. Try to weather the storm if you can. When we get the bounce it will come quickly with an overnight gap higher the next day so it will be tough to get back in.

.

.

Daily Bulletin Continues...