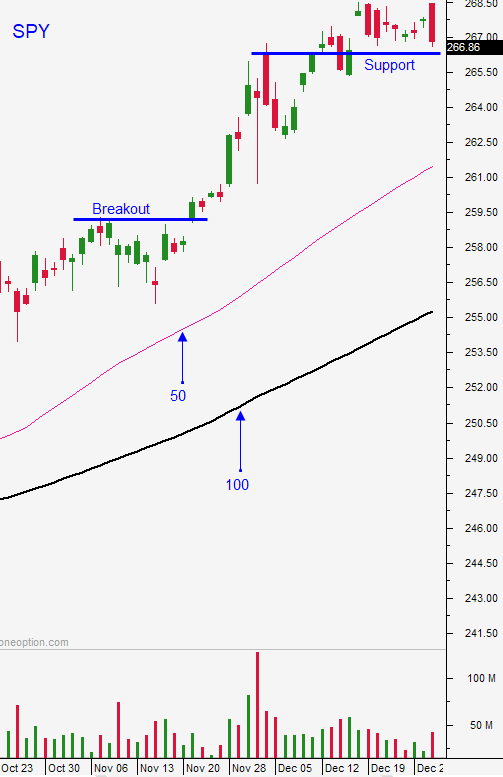

Market Breakout and Follow Through – Next Speedbump 2 Weeks Out

Posted 9:30 AM ET - This week the market rallied to a new all-time high and we can use that breakout as our stop. The follow-through has been incredibly strong and the S&P 500 is up pre-open. Stay long and use SPY $268.50 as your stop on a closing basis.

Last week I feared profit-taking. The market is giving politicians the benefit of the doubt and it is not concerned about a possible government shutdown. Earnings season will start in two weeks and buyers are engaged. If the debt ceiling negotiations get ugly and we bump up against the deadline, the market will retrace. We are likely to test the breakout at that time.

Economic releases have been very strong. ISM manufacturing came in better than expected and ADP showed that 250,000 new jobs were created in December in the private sector. This bodes well for Friday's Unemployment Report.

In my comments yesterday I told swing traders to buy calls. Ride them until the momentum stalls and take profits. Use SPY $268.50 as your stop on a closing basis.

Day traders should also ride the momentum. Trade from the long side once the early rally has been tested. Stocks have run hard the last two days and this move could be getting a little frothy. Make sure the bid is still strong and avoid an early reversal. Once the gains have held the market gradually ticks higher.

I don't see any speed bumps until the debt ceiling. We should still have two weeks of decent price action.

.

.

Daily Bulletin Continues...