FOMC Wed Will Be Hawkish – Small Speedbump Ahead

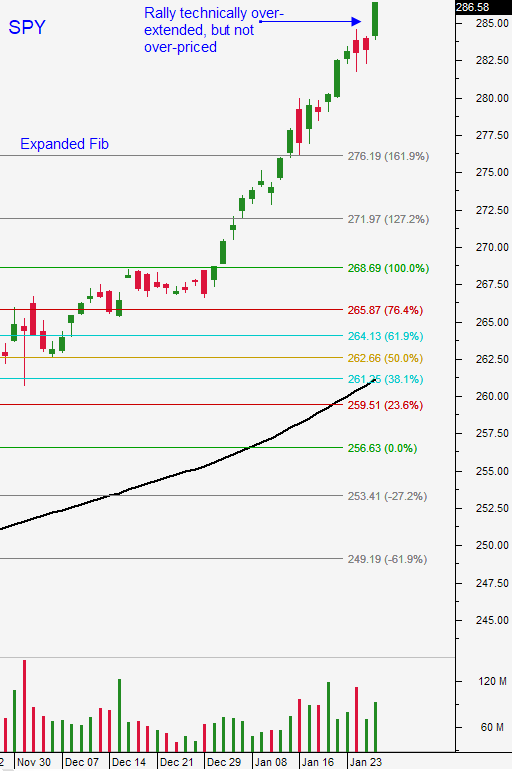

Posted 9:30 AM ET - The market is screaming higher and the S&P 500 is up 200 points since the beginning of the year. The momentum suggests that there is more upside, but we are due for a small pullback. Last Friday I suggested taking profits on half of your position. Now the other half will be easier to manage. This is a busy news week.

President Trump will deliver his State of the Union address Tuesday night. The economy is strong and tax cuts are fueling this market rally. He will take shots at the media and Democrats, but overall the tone will be positive.

The FOMC will release its statement Wednesday. They want to hike rates and they don't have to worry about spooking the market. I believe the tone will be fairly hawkish. This could be a potential speed bump.

ADP, ISM manufacturing and the Unemployment Report will be released this week. Initial jobless claims have been declining the last four weeks and I'm expecting a big jobs number on Friday.

Earnings season will ramp up this week. The news has been excellent and the guidance has been fantastic.

Democrats need to tread cautiously. The last government shutdown was not popular with Americans and according to polls Democrats were to blame. Trump is making a concession by including another 1 million unregistered illegal aliens to the DACA program in exchange for $25 billion in funding for the wall. It seems like a deal will get done and this is important because the debt ceiling needs to be extended.

This is the beginning of a long-term market rally. In the short term it is a little bit over-extended.

Swing traders should have taken profits on half of their positions Friday. Let the other half ride and raise your stops. Use SPY 85 as your guide on a closing basis.

Day traders should let the market come in. Wait until it finds support and buy the dip. Intraday volatility should start to increase and there will be opportunities on both sides.

There could be a small speed bump after the FOMC statement. Dips will be brief and shallow.

.

.

Daily Bulletin Continues...