Market Headed For All-Time High – Here’s Why

Posted 9:30 AM ET - Last Friday I told swing traders to buy on the open. Stocks shot higher on robust employment numbers and low wage inflation. We are within striking distance of the all-time high and there aren't any speed bumps for another 10 days. I expect to see a steady grind higher.

A month ago wage inflation sparked a market correction. Investors were afraid that the bull market had ended. Friday wages barely ticked higher (.1% increase) and that fear subsided. I've been mentioning for weeks that tax cut raises/bonuses temporarily boosted wages. Price inflation as measured by CPI, PPI and PCE has been benign. Oil prices have been slipping and across all fronts inflation is tame.

Economic data has been strong. ISM manufacturing and ISM services were excellent last week. The Atlanta Fed is projecting 5.3% GDP growth in Q1.

As long as economic growth is strong and inflation is moderate the market will shoulder monetary tightening. The FOMC meeting is a week from Wednesday and most analysts are expecting a rate hike. The macro backdrop is very bullish and higher yields won't spook investors. The Fed's statement will be scrutinized. Any indication of four rate hikes this year could weigh on the market. I believe the statement will be balanced and now that wage inflation has subsided the Fed will lean towards three rate hikes this year.

By historical means interest rates are low. Most analysts believe that 10-year U.S. Treasury yields will finish the year around 3%.

We’ve had a great year and we are only two months into it. We caught the early rally in January and we went to cash when the SPY fell below $285. We scooped stocks at the 100-day moving average and made about 70 S&P points before going back to cash. The best move was when we bought at the 200-day moving average and captured over 200 S&P points in a few weeks. Over the last two weeks we let some of the volatility come out of the market and now we are back in at an excellent entry point.

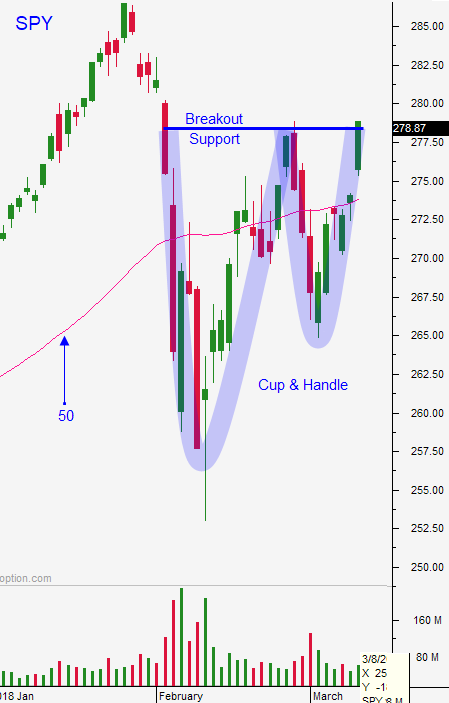

Swing traders should remain long. Use the 50-day MA as your stop on a closing basis. I believe we will challenge the all-time high the next month.

Day traders should wait for the bid to be established today. After a big run on Friday I'm expecting a little probe for support this morning. Look for opportunities to get long. Support is at $278 and we want to see that level hold.

.

.

Daily Bulletin Continues...