Buy Calls On This Index Now – Market Is Going Higher

Posted 9:30 AM ET - Yesterday we saw how resilient the market is. A trade war between China and the US is unfolding and investors are not deterred. After an initial drop, stocks spent the rest of the day recovering. That reversal paved the way for higher prices this morning and the S&P 500 is seven points higher before the open. We are going to get long today.

Trump announced an additional $200 billion worth of goods that could be subjected to new tariffs. China promised to retaliate and they will counter with new tariffs of their own. The world's largest economies are jousting. If market performance is any indication, the US has the upper hand. The S&P 500 was down .5% while China's market fell 4% to a 2-year low.

Overnight the PBOC injected $37 billion to calm nerves. They also suggested that bank reserve requirements could be reduced.

Economic growth is strong, corporate profits are robust and stock valuations are reasonable at a forward P/E of 16. The market has shouldered all of the bad news thrown at it during the last week (trade wars and a hawkish FOMC statement) and it wants to run.

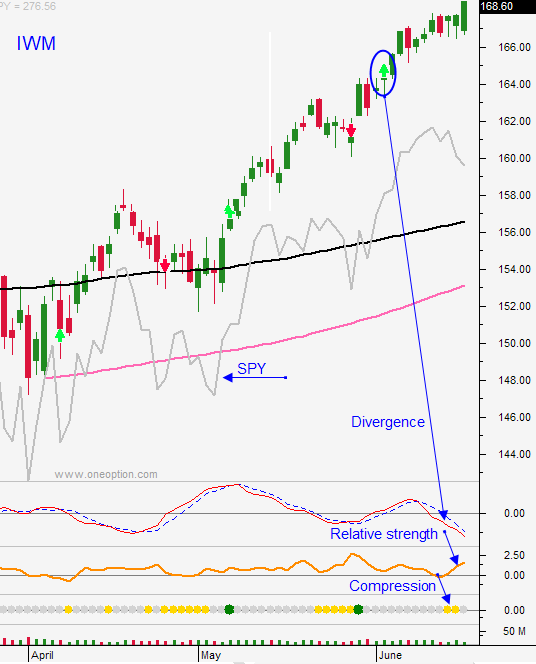

Swing traders should buy IWM on the open today. Small cap stocks have little exposure to trade wars. They will benefit from strong domestic economic growth and tax cuts. Use a close below $166 as a stop.

Day traders should focus on the long side this morning. Make sure the early gap higher is legitimate. If the market does not drift lower in the first 30 minutes the risk of a reversal will be low. Buy stocks and watch for a gradual grind higher. If the market is above the first hour high add to positions and use that as a stop.

We have waited patiently for the bid to be tested and we have confirmation. Buyers are lined up and the market is going higher.

.

.

Daily Bulletin Continues...