Market Wants To Rally – News Is Light – Stay Long and Use This Stop

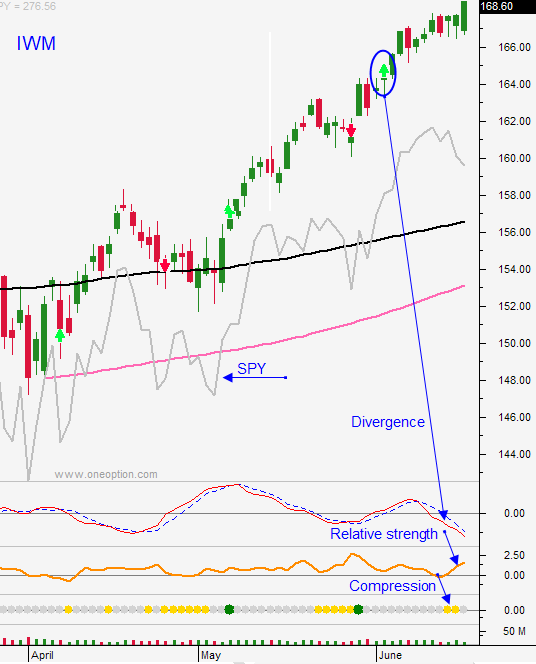

Posted 9:30 AM ET - Yesterday the market took a breather. The news has been fairly light and the SPY is compressing near the upper end of its range. Tech stocks and small caps are strong on a relative basis. Thursday's losses will be pared on the open and the S&P 500 is up 14 points.

Heated tariff rhetoric between China and the US has not dampened investor spirits. The world's largest economies are battling it out. Europe imposed additional tariffs on US goods and the market did not flinch. If these "taxes" become reality it will take many months before the effects are known.

Economic data points have been strong. Stocks are trading at a reasonable forward P/E of 16 and guidance is robust. Interest rates are low by historical standards and inflation is moderate.

The market has shouldered the trade war news and hawkish statements from the Fed in the last week. That is a bullish sign.

Swing traders are long IWM calls and we will use $166 as a stop on a closing basis. Small to medium-size businesses have limited tariff exposure and they will benefit from domestic growth/tax cuts.

Day traders should make sure that the early gains hold today. If the market is able to tread water for the first hour it will grind higher. Look for opportunities to get long. Use the first hour range as a guide. Once the momentum is established go with the flow.

The market will tenuously grind higher while it digests tariff news. Earnings season is a few weeks away and the bid is strong. The news will be light for the next two weeks.

.

.

Daily Bulletin Continues...