Trade War Fear Is Keeping A Lid On the Market – Good News Ahead

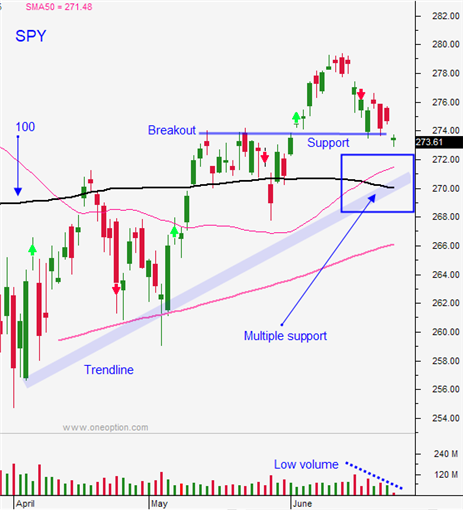

Posted 9:30 AM ET - PRE-OPEN MARKET COMMENTS MONDAY - The S&P 500 is trapped in a 40 point range and the pressure is building. Support is at SPY $270 and resistance is at $274. A major holiday will bisect the trading week and major economic releases will be in focus. This market compression will be resolved shortly and the it will breakout or breakdown.

Trade wars are escalating and all of our partners have outlined retaliatory tariffs. The steel and aluminum tariffs will go into effect at the end of this week. China, the EU, Canada and Mexico will respond if Trump follows through. Mexico elected a hard left candidate who is demanding respect from the White House. Trump said that he will wait for the November midterms before he negotiates NAFTA.

China's stock market has been dropping and it is down more than 20% from its high this year (bear market). The PBOC has injected $70B into the financial system and they could devalue the Yuan to offset tariffs. Xi also said that China would stop buying US Treasuries. China has kept North Korea at the table and now we are hearing that Kim has increased production at its primary nuclear facility. From the very beginning I believe China used North Korea as a pawn to secure a favorable trade deal. Now that US trade negotiations have stalled, China could lift sanctions against North Korea. I hope I am wrong – time will tell.

China plans to become the most powerful country in the world by 2025. The biggest threat is that China’s economic growth stalls and that the shadow banking industry starts to default. If Trump knows one thing it is real estate. He knows that China has incredible exposure (50-60 million vacant homes). I will be watching for signs of strain. Credit is the only thing that can cause a prolonged market correction.

Trump is spread very thin and he has picked fights with friends and foes alike. He needs to close the loop and formalize trade agreements with countries one by one. This needs to start right away if he is going to maintain his popularity into the November mid-terms.

This negative backdrop is weighing on the market. If not for trade wars, the market would be making a new all-time high. The economic numbers this week will be excellent.

Official PMI's were little soft and China's number slipped (51.5 vs 51.9). ISM manufacturing will be posted after the open. ISM services, ADP, the FOMC minutes and the Unemployment Report will be posted this week.

Next week companies will start announcing earnings. Profits excite investors and stocks have the potential to bounce on the news.

Swing traders are long IWM around the $166 level. The rebalancing is over and the dividend will be paid tomorrow. After that I expect IWM to outperform the S&P 500. That does not mean that it will go down if the market breaks key support. The Russell 2000 is less exposed to the impact of tariffs. We will hold without a stop until earnings season is underway.

Day traders should let the early action play out. Use SPY $270 as your guide. I will be looking for stocks with relative strength this morning. If the SPY bounces I will buy these stocks and I will use $270 as my stop. If I don't get the move I will stay sidelined and I will wait for the momentum to be established. Go with the flow and use $270 as your guide.

Swing trading is been extremely difficult with these political crosswinds. I am focusing on day trading until we breakout of this range.

.

.

Daily Bulletin Continues...