Time Decay Will Be An Issue For Option Buyers In August – Here’s Why

Posted 9:00 AM ET - The market has been very choppy the last two weeks as it trying to breakout on strong earnings. Political headwinds are keeping a lid on the rally and conditions are not likely to change in the next month. An interest rate hike and the continuing resolution will loom over the market in September. The S&P 500 is trading at a reasonable forward P/E of 16 and dips will be shallow and brief. Traders and politicians will take time off the next few weeks so the volume will be light.

Earnings season is winding down and retailers will start reporting soon. The results should generally be good.

Domestic economic conditions are strong, but we are seeing some weakness in Europe and China. Germany's factory orders dropped 4% in June and England will exit the EU without a trade deal (hard landing). China's official PMI was light in July and exports are down. Trump feels the US has the upper hand and he is pushing forward with tariffs against China. The rhetoric is very heated and China is “prepared for a prolonged battle”.

The Fed is tightening aggressively and the FOMC statement last week was hawkish. We can expect a rate hike in September and perhaps another in December. Wage inflation was moderate in the jobs report and that is not driving the Fed's agenda.

Trump wants immigration reform and he is threatening to shut down the government if Congress can't pass a bill. The continuing resolution deadline is September 30th.

Politicians and traders typically take time off in August and investors get nervous when no one is "minding the shop".

Domestic economic strength and robust earnings are keeping a bid to the market. However, dark clouds (tariffs, continuing resolutions and an interest rate hike) are looming - the front is approaching (September).

Swing traders should be sidelined. The upside is limited and our best strategy is to wait for a drop. When we get that pullback there will be an opportunity to buy stocks at better levels. The bounce off of that low will lead to a sustained rally that could last a few days or a couple of weeks. That momentum could provide an opportunity to buy calls – we need that momentum. Option buyers need to be very careful in this environment. Opposing forces will keep the market in a tight range and time decay will be an issue.

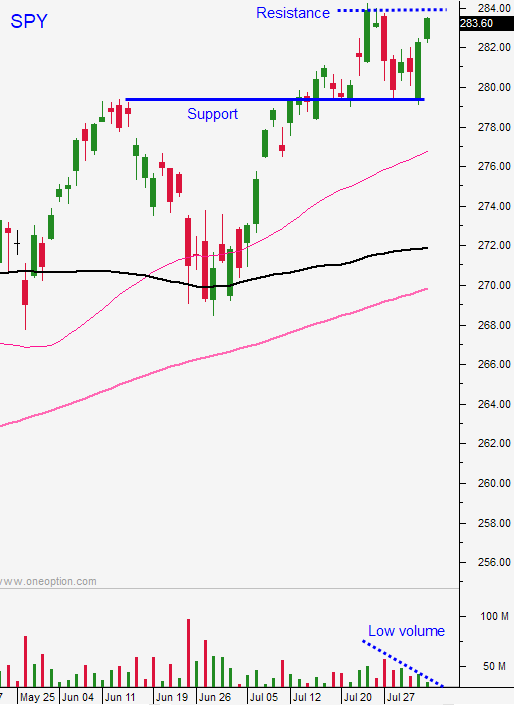

Day traders need to use the first hour range as a guide. If we are above it, favor the long side and if we are below it favor the short side. The SPY is firmly above support at $280 and the QQQ needs to get above resistance at $180. Trim your size and your trade count. We are heading into the summer doldrums and this is a low probability trading environment.

.

.

Daily Bulletin Continues...