S&P 500 Is 10 Points From All-time High – Breakout Could Spark FOMO Buying

Posted 9:30 AM ET - The S&P 500 and NASDAQ 100 indices are on the verge of making new all-time highs. The news is light and momentum will float stocks higher. If the market breaks out we could see FOMO (fear of missing out) from latecomers.

Almost 80% of the companies that have reported earnings have exceeded estimates. If this holds it is the highest level since 1994. Profits are on pace to grow more than 20% and the guidance has been excellent. At a forward P/E of 16, the market is reasonably priced.

Domestic economic growth is strong and inflation is moderate. As long as these conditions hold true a rate hike in September won't dampen investor spirits.

A possible trade war with China looms over the market. The rhetoric is heated and the PBOC has been easing. Today we learned that Chinese exports grew 12.2% (10% expected) and imports grew 27.3% (16.2% expected) In July. This growth should calm investor nerves. China's market has dropped 30% from its high of the year and these trade numbers will temporarily stop the bleeding.

President Trump has threatened a government shutdown if immigration reform is not passed before the continuing resolution deadline on September 30th. Time is running out and politicians will be on holiday the rest of the month. The market will discount the likelihood of this happening since it would not play well for Republicans ahead of the mid-term elections.

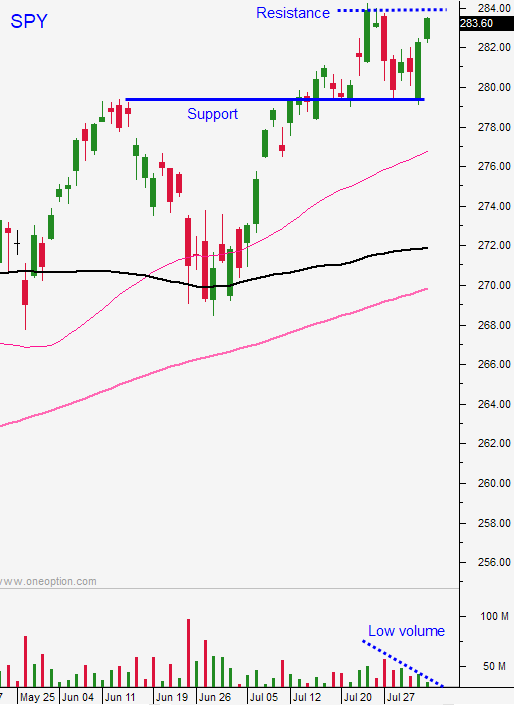

Earnings season is winding down and economic releases are light. Momentum will drive the action and it currently points higher. I expect to see low-volume and a tight range the rest of the month.

Swing traders bought a half position of SPY on the open yesterday. Hold without a stop and know that we will add on dips. All of the headwinds have not been able to keep a lid on this rally. Record earnings growth and reasonable valuations are keeping buyers engaged.

Day traders need to focus on the long side. Buy dips once support is established. If the market rallies above the first hour high, get more aggressive with your longs. If the SPY trades above $286.60 hold some of your longs overnight. I still consider this a low probability trading environment due to the lack of volume. I will only trade a third of my normal size to start. If the market is able to rally above the first hour high I will increase my size to half of my normal position. If the market is able to make a new all-time high I will trade my normal position size.

Yesterday we saw an opening move and a tight range the rest day. We are in the summer doldrums and this is the price action we should expect the next few weeks.

.

.

Daily Bulletin Continues...