Market Is Flirting With the All-time High – Mexico Close To Trade Deal

Posted 9:30 AM ET - The S&P 500 has been flirting with the all-time high this week. The news is light and we need a catalyst to push us through. Rumors of a trade deal won’t do it - we need a signed agreement and that is not likely to happen before Labor Day.

Trump is close to a handshake deal with Mexico and there are rumors it could happen today. That would be market friendly, but it would not be enough to generate a sustained move. The US currently has a handshake agreement with Europe and the progress is slow. Politicians are on vacation.

Tariffs were imposed on China ($16 billion) today. China is retaliating and the rhetoric has been negative. Low level trade negotiations are taking place.

Flash PMI's were generally in line with expectations.

The FOMC minutes yesterday did not spark a move. Powell will speak tomorrow and the reaction will be muted. The market is prepared for Fed tightening and as long as economic growth is strong and inflation is moderate it will absorb the rate hikes.

Earnings season is almost over and the results have been fantastic.

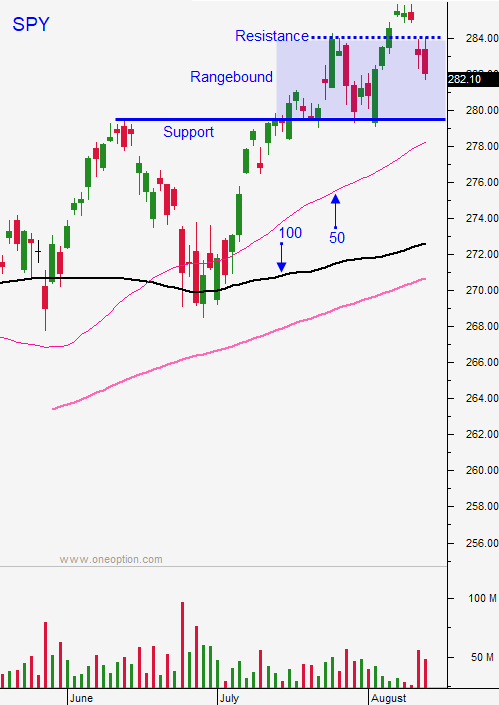

Swing traders are long SPY and we will add if the SPY hits $280 or $287. I would rather buy a dip, but we would buy a breakout as well. The market will compress near the all-time high and normal trading will resume in two weeks. The daily ranges will be narrow.

Day traders should try to buy dips. Identify strong sectors each day and focus on stocks that have relative strength. Set passive targets and take profits quickly. Reduce your trade size and trade count. If a trade deal is signed with Mexico (unlikely), ride the momentum. Major news announcements are not expected and they could result in sustained directional movement since there is no one to stand in the way. Again, I'm not expecting this to happen. Tight ranges each day are likely.

This is a low probability trading environment. Take time off. There will not be much to report next week and I will not be publishing market comments from August 27 to August 31.

.

.

Daily Bulletin Continues...