Market Needs News – Tight Range and Low Volume Will Last Another Week

Posted 9:30 AM ET - The market wants to go higher but it needs good news. A trade deal with Canada or the EU would suffice. A dovish statement after the Fed raises rates next week would also attract buyers. Congress is likely to approve a budget in the next two weeks and that would also help. Without any of these drivers, stocks are likely to trade in a tight range on light volume.

Buyers have not been deterred by the tariff battle between China and the US. Both countries are trying to prove that they have the upper hand. Trump imposed a 10% tariff on $200 billion worth of Chinese goods and that will increase to 25% at the end of the year if they can't strike a deal. I believe that China will not sign a deal before the elections. They want Democrats to win the House so that Trump's agenda stalls. The market will ignore the tariff war until companies post earnings warnings.

Trade talks with Canada and the EU are progressing.

Emerging market yields have been creeping higher and credit conditions are deteriorating. This is a longer-term concern. Credit markets are stable, but fragile.

The FOMC statement next week will not be dovish. They will continue to tighten gradually and wage inflation will be a concern.

Domestic economic growth is strong and corporate profits are robust. Stocks are reasonably valued at a forward P/E of 16.

The potential for conflict in Syria has temporarily subsided. Iran will try to shut down the Strait of Hormuz when economic sanctions are opposed in November.

All of this news is in the marketplace and there really isn't anything that can blindside investors. The focus is on current profits and longer-term concerns are being discounted.

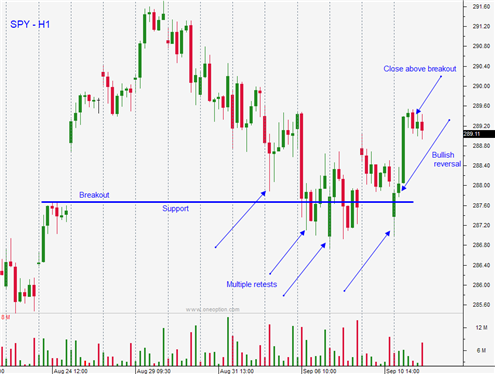

Swing traders are long SPY and they should use an intraday stop at SPY $287. Interest rate concerns will dissipate after next week and Congress should be able to pass a budget. Canada is scrambling to get a deal done before NAFTA expires in two weeks. We are probably not going to see a deal with Europe before the November elections, but talks have been productive. The market is not overly concerned with the Chinese trade war, but that will change when companies start warning. I'm expecting a very tenuous grind higher with a couple of pieces of positive news. The market tested the breakout and that support level held. That is a bullish sign.

Day traders should use the first hour range as a guide. If we are above the high, focus on the long side. If we are below the low, focus on the short side. Overseas markets were generally positive and the market should be able to reverse yesterday's losses.

Without a major news event the market will chop around in a tight range. We could be in this pattern for another week.

.

.

Daily Bulletin Continues...