I Don’t Trust This New Market High – I’m Long and I’m Raising My Stop

Posted 9:30 AM ET - The S&P 500 is going to open at a new all-time high this morning. There isn't any overnight news to justify the move. Momentum is pushing stocks higher and quadruple witching will help. These opening gaps higher have frequently been faded this year. We will raise the stop on our SPY position today.

Trade negotiations between the US and China are strained. The US is threatening to increase the rate to 25% and China is threatening to lower tariffs on all other TRADE partners. China will also sell US treasury holdings and they might halt shipments of critical electronic components. Chinese trade officials are not expecting any deal until after the November elections. This battle is intensifying and the market does not care - yet.

Canada is trying to sign a trade agreement before NAFTA expires in a few weeks. Negotiations with the EU are taking place, but there is no progress. Europe is fragmented and decisions take longer than normal. The EU is also trying to negotiate Brexit and those talks have stalled.

The FOMC statement will be released next Wednesday and a rate hike is expected. Wage inflation will keep the Fed in tightening mode and at best the comments will be neutral. Higher yields in the US will elevate yields in emerging markets. Argentina, Venezuela, Pakistan, Italy, Turkey, Russia and many other countries are struggling with currency devaluation and credit concerns are looming.

Domestic economic growth is strong. The Atlanta Federal Reserve is keeping its projection for Q3 growth at 4.4%. Initial jobless claims fell to 201,000 and that is the lowest level we've seen in many years.

Corporate profits are at record levels and guidance is strong. Valuations are reasonable at a forward P/E of 16. This has been the primary "driver" for the market. The backdrop could change quickly if companies start to warn because of tariffs.

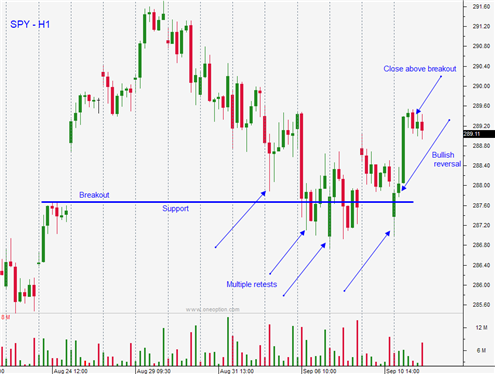

Swing traders should raise the intraday stop on the SPY to $290. Our target is $300 and we will keep raising our safety net until we get there. Tech stocks have lagged and the market could get a boost if this sector gains traction.

Day traders should watch the opening rally very closely. If the bid starts to crumble immediately, look for opportunities to short. I don't believe the market will stage a sustained rally without positive news and we could see a reversal today. If the market hangs on to early gains the bid will strengthen. A new high after two hours would be bullish and then you can consider longs.

Quadruple witching will result in volatility. I believe that a series of rallies and dips is more likely that a sustained grind higher today.

Many of the issues I've outlined will be resolved in the next few weeks. Asset Managers will not be overly anxious to buy at the all-time high until they have clarity.

Stay long and use protective stops.

.

.

Daily Bulletin Continues...