Buy Puts If This Happens Today – Unlikely But Possible

Posted 9:30 AM ET - Earnings season has climaxed and strong profits justify the recent bounce. The market is within striking distance of the 200-day moving average, but resistance is stiff. At a forward P/E of 16 stocks are trading near the upper end of their valuation range. Good news is priced in.

Trade talks with China will continue next week and that suggests progress. Trump and Xi immediately scheduled the next meeting and both sides are anxious to find middle ground. Trump needs a deal to gain political clout and Xi needs it because his economy is slipping.

Theresa May will go to Brussels to renegotiate the border in Northern Ireland. That region wants to remain part of the EU. If a deal can’t be struck it could mean a hard Brexit. This would not be good for European markets. The deadline will not be extended and Brexit will happen March 29th one way or the other.

Germany's industrial output fell .4% (+.7% expected) and the largest economy in the Eurozone is struggling. Last week we learned that Germany’s December retail sales declined 4.4% year-over-year. Italy is officially in a recession and 2019 growth forecasts have been reduced to .2% (from 1.2%).

India unexpectedly cut its interest rate by a quarter-point overnight. This could be a sign of deteriorating economic conditions in that country.

Domestic growth is robust, but the rest of the world is decelerating. Trade deals will keep global economies from falling off a cliff, but they won't stop this trend. A slowdown in global economic activity is the greatest market threat.

The Fed has been more dovish, but that tone will change now that the market has recovered. They still plan two hike rates this year and the market is not pricing in any rate hikes. This means there is a downside surprise component.

A government shutdown next week is unlikely in my opinion. Polls suggest that more than two thirds of the country support border fortification. After the State of the Union Address, Trump's approval rating has improved. Voters will blame Democrats if there is another shutdown. If Trump has to veto the bill he will take appropriated (but unspent) funds from other areas to build the wall/fence. The government shutdown has not had any market impact, but it will if an agreement can't be reached. That would be a sign of dysfunctional in DC and the next shutdown will impact economic growth.

Earnings season has been fantastic. Earnings per share are up 18% on average and more than 70% of companies have exceeded estimates. Both of these statistics are above average. Now that mega cap tech stocks have reported, sellers will get more aggressive.

If you only consider domestic economic growth and earnings growth the market should climb from here. Unfortunately, there are many other factors in play.

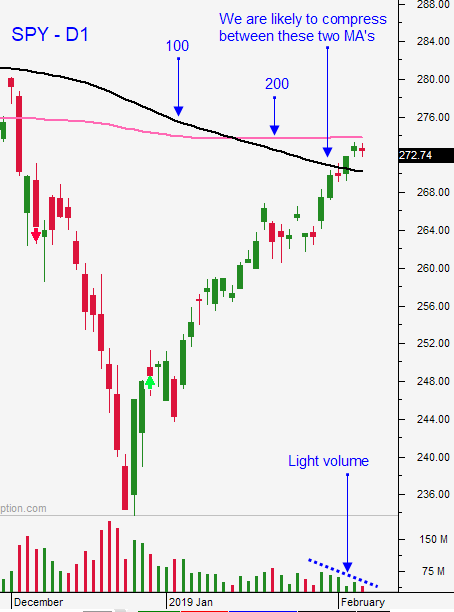

Swing traders should short the SPY if it trades below $270. Only take a half position and use $276 as your stop on a closing basis. I've been waiting for signs of exhaustion and I'm starting to see them. The market did not advance on incredibly good news Friday and sellers are not waiting for the 200-day MA to be tested. The strong bid from January will be hard to turn. I believe $270 will hold and the market will recover most of its losses today. Germany's industrial output is insignificant (as a single number) and the market should recover most of the losses today. The drop is coming, but not yet. If this number sparks broad based selling it would be a very bearish sign.

Day traders should let the dust settle on the open. I believe we will see a small bounce and when it runs out of steam we will test the bid. The market will not have a meaningful rally until the downside is tested today. Support at $270 must hold. If it fails we will see follow-through selling. China's market is closed this week and trading volume is a little lighter than usual. I believe that support will hold today. The news has generally been good and the market still wants to price in positive outcomes from the issues mentioned above. A drop down to the 100-day MA would present a good buying opportunity for day traders today.

From the bearish standpoint I want to see late day selling and follow through the next day. The early drop this morning feels bearish, but we are likely spent some time between $270 and $274.

.

.

Daily Bulletin Continues...