Market Is Tired – Watch For 2 Bearish Signs This Week

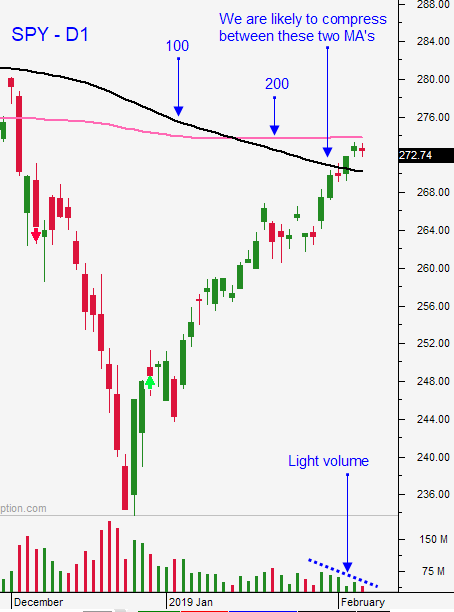

Posted 9:30 AM ET - Last week the S&P 500 rallied above the 100-day moving average and it was within striking distance of the 200-day moving average. Resistance was stiff at that level and profit-taking pushed the SPY back below the critical $270 level. After a nice bounce in January stocks look tired. There are many unresolved issues and two of them will impact market direction this week.

A government shutdown in the US is possible. Politicians needed to find middle ground last week to pass a bill before the deadline Friday. We just came off of the longest government shutdown in history and another one is very possible. The market is discounting this event and the next one will negatively impact economic growth.

China and the US will meet for trade negotiations this week. The next meeting was immediately scheduled and that is a positive sign. Unfortunately, US officials engaged in the negotiations mentioned that both sides are still far apart. We won't see a deal for many months, but as long as progress is being made the market will be patient. Any negative comments or delay of future meetings will be bearish. Trump had an opportunity to meet with Xi at the end of February and he declined.

Theresa May was going to hold a Parliament vote on Valentine's Day. She is trying to renegotiate the Irish border with the EU and they have not been receptive. She is trying to delay the vote so that she can get some concessions that might satisfy Parliament. With only 47 days to go a hard exit is still possible (bearish).

Earnings season has been excellent. Stocks are trading near the upper end of their P/E range and good news is priced in. Mega cap tech stocks have reported and the announcements climaxed last week. Profit takers will be more aggressive from this point forward.

The Fed has been dovish, but that tone could change with higher stock prices. They want to tighten and two rate hikes are planned in 2019. The market is not pricing in any rate hikes so there is a disconnect (bearish).

Swing traders are short the SPY. We are seeing a small relief bounce this morning and buyers will try to push the market back above the 100-day MA. If that happens and support at $270 is established we will exit our position. Use a closing stop of $272. I still believe the next big move is down, but we might early. Here are two bearish signs to watch for: a few consecutive closes below SPY $270 and late day selling with follow through the next day.

Day traders should use SPY $270 as a guide. If we are below it, favor the short side and if we are above it favor the long side. Also use the first hour range to get more aggressive with your positions. If we are above the high or below the low - trade larger size. China's market reopened after a one-week holiday and trading volumes should improve this week.

I believe a government shutdown could happen and I believe the EU will not accommodate Brexit. These two events could weigh on the market. Comments from trade negotiations with China will be friendly, but I don't trust lip service. The next meeting needs to be scheduled immediately to keep the ball rolling.

.

.

Daily Bulletin Continues...