Quad Witching Rally Will End Today – Price Compression Next Week

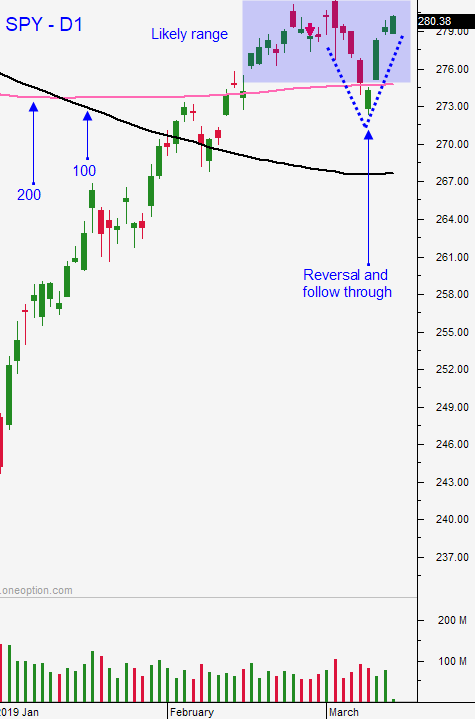

Posted 9:30 AM ET - Yesterday the market was able to hold the new support level at SPY $281. Quadruple witching has helped fuel this rally and the S&P 500 is up another 13 points before the open. Now that we have moved through a major resistance level the momentum should push the market higher.

The news is very light. Comments regarding a US/China trade deal are encouraging and China has agreed to intellectual property protection. Trade officials believe that a signing could happen in April. Much of this news has been in the marketplace.

China's industrial production fell to a 17 year low, but investors are more interested in easing by the PBOC. China has been reducing bank reserve requirements and a fiscal spending program is planned. They also considering a reduction in value added taxes (VAT).

Global economic growth is deteriorating, but investors are focused on strong US data points. As long as our economic growth is solid the market will move higher.

England voted to delay Brexit and Theresa May is headed back to Brussels to ask for an extension. Lawmakers are in a stalemate and the England could remain in limbo indefinitely. Corporations do not like uncertainty and they are moving production out of the country.

North Korea has threatened to end talks with the US and to resume rocket tests. Investors don't seem overly concerned.

The FOMC statement will be released next week and the tone should be dovish. Fed officials have been vocal in recent weeks and there should not be any surprises. Most officials still expect one more rate hike this year and the balance sheet roll-off should end in six months.

Swing traders should remain in cash. The Quadruple Witching rally will end today and the market will compress next week. I want it to gather strength and I want to assess global economic conditions. I still believe that a trade deal will not stop the deceleration in global activity. China is pulling out all the stops to keep their growth at its current level. Europe is slipping each month. This rally feels great, but there is an undertow that is being ignored.

Option expiration will lead to choppy trading. You should expect two-sided action. Use the first hour range as your guide and be more aggressive buying dips. We are above $281 so favor the long side.

We are in a news vacuum and the action will be light next week.

.

.

Daily Bulletin Continues...