Market Will Compress This Week – Dead Till the Fed

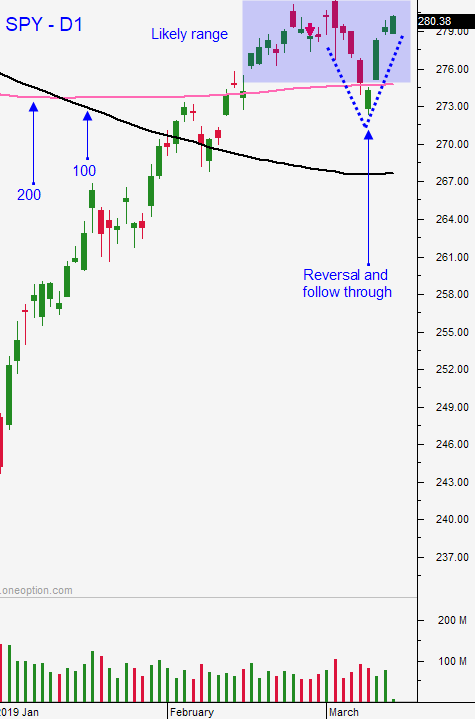

Posted 9:30 AM ET - Last week the market rallied through horizontal resistance at SPY $281 and quadruple witching fueled the move. Regardless of how it got here, buyers are still engaged. Positive outcomes for all of the issues are priced in and the upward momentum strong.

We will be in a news vacuum for a while. Typically the FOMC statement is a market driver, but not this week. Fed officials have had speaking engagements and congressional testimonies in the last month. They have been very vocal and there will not be any surprises. Most Fed officials want to hike at least once more this year and zero rate hikes are priced in. The balance sheet roll-off should end in Q4. The FOMC statement on Wednesday should be consistent with recent “Fed speak”.

Theresa May is scrambling to secure votes for her EU exit agreement. Last week she got assurances from the EU that Irish border inspections would not be imposed. If she can't get the agreement to pass a prolonged Brexit extension will result. The deadline is 2 weeks away.

A trade agreement with China will take time. A summit with Xi has been postponed. Many analysts thought it might happen in March and now June looks more likely. This is a sign that there are still wide gaps that need to be filled.

Japan's exports fell for a second straight month (-1.2%). This follows a sharp 8.4% decline in January. The warning signs of a global economic slowdown are everywhere, but investors don't seem to care as long as the contraction stays abroad.

This may not have a major market impact, but North Korea has threatened to resume rocket testing.

Swing traders should remain in cash. The quadruple witching rally pushed us above major horizontal resistance, but the action will grind to a halt this week. I expect a compression for a few weeks and during that time additional economic releases could weigh on the market. As I outlined in my comments, all of the issues are being discounted. The upside rewards are smaller than the downside risks.

Day traders should favor the long side. Look for dull trading and compressed intraday ranges. Traders will be in a holding pattern ahead of the FOMC statement and it will turn out to be a “great big nothing burger” (muted reaction). Then we will wait for the next potential catalyst. Use the prior day's range as your guide. If we are above the high you can get more aggressive with your longs. If we are above the first hour high you can lean on that as your stop. We are likely to establish the daily range in the first hour. If this happens, fade the extremes.

Prepare for quiet week ahead.

.

.

Daily Bulletin Continues...