Market Will Test All-time High – China’s Numbers Will Be Important

Posted 9:30 AM ET - The market is waiting for a catalyst and earnings could push stocks to an all-time high. Valuations are at the upper end of their range and good news is priced in. Buyers are typically engaged through mega cap tech announcements and the bid should remain strong for two more weeks.

Financials jumped last Friday and they have taken a pause. Bank earnings were fueled by higher interest rates and the results yesterday were good, but not spectacular. Netflix and IBM will report after the close today. The announcements will really crank up next week.

Signs of disinflation are surfacing and the Fed will consider a rate cut if it drops below 1.5% according to one official. After being so hawkish last year I don't see them shifting that quickly. This “Fed speak” sparked buying and stocks are up this morning.

Trade talks with China are progressing and we could have a deal in the next few weeks. The first-round of talks with Japan started yesterday and the EU has approved trade negotiations with the US.

China will report industrial production, retail sales and GDP tomorrow. Many analysts feel that their economy is showing signs of a recovery and these numbers will confirm/reject that theory. On Thursday Europe and Japan will report flash PMI's.

Domestic economic releases have been solid. The Beige Book will be released tomorrow afternoon. Flash PMI's, the Philly Fed and retail sales will be posted Thursday.

This is a holiday shortened week and the volume will be fairly light. Earnings releases will kick into high gear next week. I'm expecting a steady grind higher for the next few days, but the headwinds will be blowing as we approach the all-time high.

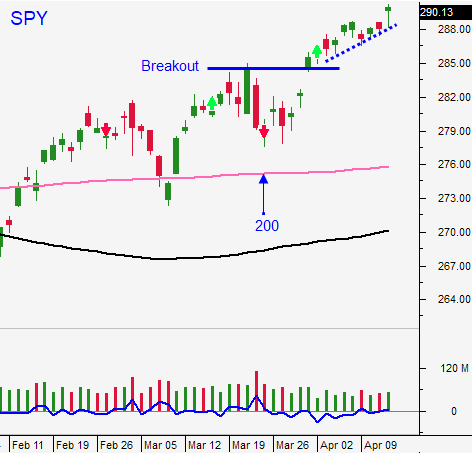

Swing traders are long a half position of SPY. Raise your intraday stop to SPY $288. As the market moves higher we will keep raising our safety net.

Day traders should wait for an early dip. Opening gaps higher have been faded and the bid will be "checked". Once support is established buy stocks with relative strength that are breaking through horizontal resistance. You won't have a market tailwind so you need to make sure that the stock has momentum. This pattern produces sustained rallies with follow through.

Look for quiet trading with an upward bias.

.

.

Daily Bulletin Continues...