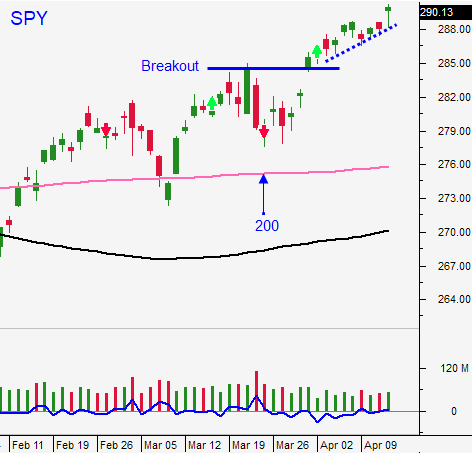

Ride the Rally and Keep Raising Your Stop

Posted 9:30 AM ET - The market has been gradually floating higher and it is within striking distance of the all-time high. China's economic data was good and it seems that growth has stabilized. Flash PMI's this morning were soft in Europe and Japan. Traders are focused on earnings and they have been good so far.

China's industrial production, retail sales and GDP all came in better than expected yesterday. China is the growth engine of the world and the market will not move higher if its economy stumbles.

Flash PMI's from Europe came in at 51.3 (versus 51.8 expected) and flash PMI's from Japan were 49.5 (up from 49.2). Growth in both areas is slowing.

Retail sales in the US increased 1.6% and the S&P 500 rallied 4 points on the news. The Philly Fed came in at 8.5 and that was a bit light (11.0 Expected).

Trade negotiations with China continue and both countries expect a deal in May. Trump will decide on auto tariffs May 18th and trade negotiations with Europe and Japan will begin.

Earnings so far have been good and today we will see how cyclical stocks react. Major announcements will begin next week. Stocks are trading at the upper end of their valuation range and good news is expected.

Swing traders have a half position of SPY and they should use $289 as a stop on an intraday basis. Tomorrow is an exchange holiday and the volume will be fairly light today.

Day traders should wait for a dip and buy once support is established. The pattern of an early drop has been repeating for two weeks and the market recovers late in the day. The intraday range will collapse after two hours. Keep your trades small and reduce your activity.

The market needs a catalyst to push through the all-time high and earnings next week could do the trick.

Happy Easter!

.

.

Daily Bulletin Continues...