Can the Market Make A New All-Time High? This Is A Critical Week

Posted 9:30 AM ET - The market will open ten S&P 500 points lower this morning. Nervous jitters after a three-day weekend are to blame. I'm not reading too much into this move since the headlines are light. Many overseas markets (most of Europe, Australia and Hong Kong) are closed.

China will focus more on structural reform and fiscal spending will be less than the market was expecting. Stocks in Asia are trading lower on the news and that is weighing on overseas markets.

China's economic numbers have been ticking higher and a gradual decline has temporarily stopped. A trade deal with the US could be signed in the next few weeks and that will keep a solid bid to their market.

The Fed is dovish and some officials even suggested a rate cut in 2020 if inflation stays below their 2% target. I believe we are a long way from that. Oil prices are moving higher along with hourly wages and that will keep inflation at its current level.

Many mega cap tech stocks (FB, MSFT, ANZN and INTC) will report this week. Stocks are trading at the upper end of their valuation range and good results are expected. The guidance will be critical and it will determine market direction.

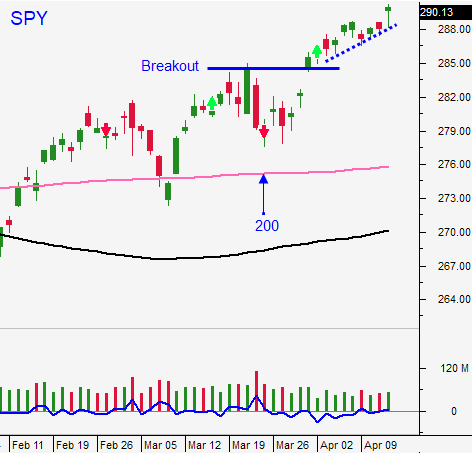

Swing traders are long a half position of SPY. We will use an intraday stop of $288 and a closing stop of $289. We will keep raising our safety net as the market moves higher. The headwinds are blowing as we approach the all-time high.

Day traders should wait for support. Once it is established buy strong stocks. I believe the early dip will run its course and it will set us up for a nice bounce. I will run a search in Option Stalker that finds stocks that are reporting this week and that tend to rally into earnings. This market dip will provide a great entry point.

The price action this week will tell us if the market has enough strength to challenge the all-time high. It's all about earnings this week.

.

.

Daily Bulletin Continues...