Will Mega Cap Tech Earnings Be Good Enough?

Posted 9:30 AM ET - Earnings releases will determine if the market can break through the all-time high. Stock valuations are at the upper end of the trading range and good news is expected. Major tech companies will announce this week and they will set the tone.

Microsoft, Intel, Amazon and Facebook will report in the next few days. Buyers are engaged during these announcements and they typically spark optimism. There are also a number of cyclical companies that will report earnings. This could be the first quarter where profit margins decline due to higher input costs.

The economic news is light this week. China's activity has upticked slightly and traders are latching on to those numbers. Domestic activity has been solid, but a little below expectations.

The Fed is dovish and there won't be any rate hikes this year. The balance sheet roll-off will end in October. This stance will keep buyers engaged.

A trade deal with China is likely in the next few weeks.

Brexit will not impact the market until September.

Global economic conditions are tenuous in my opinion and investors are discounting the possibility of a slowdown. It will take a few consecutive months of negative data to shake investor confidence. Until then, buyers will scoop stocks on dips. A series of earnings warnings could also spoil the mood. I DON'T see that happening to on a large scale this quarter.

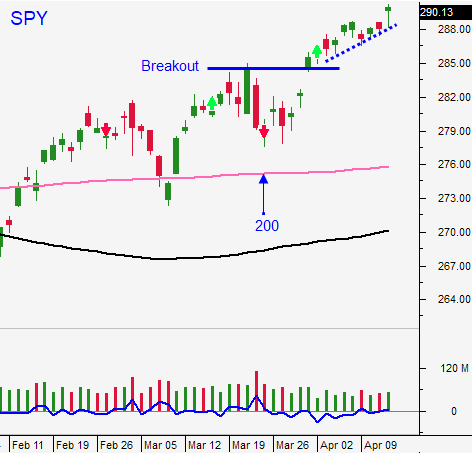

Swing traders should hold the half position of SPY. Use an intraday stop of $289 and set a target of $293. We will adjust these numbers as the market moves higher.

Day traders should buy dips. Wait for support to be established and buy. Yesterday you had to scoop stocks right on the open. The move unfolded in the first hour and then prices compressed the rest of the day. I am expecting better intraday action the rest of the week. Earnings will fuel market movement.

.

.

Daily Bulletin Continues...