New Tariffs Imposed – Here’s How the Market Will React

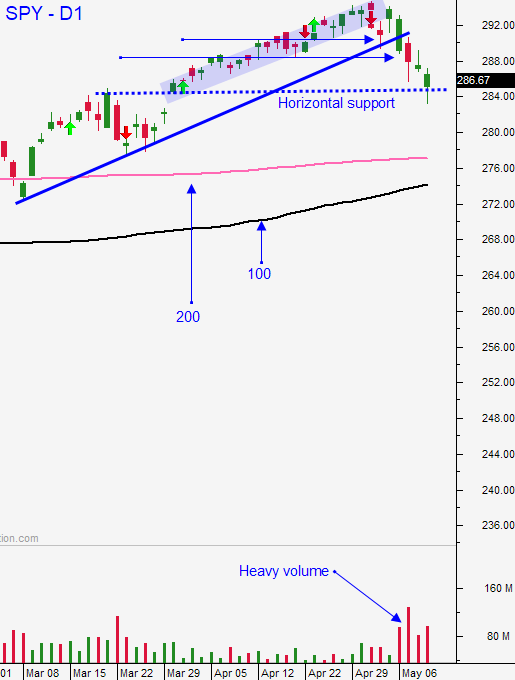

Posted 9:30 AM ET - Yesterday the market dropped below horizontal support at SPY $285 at the start of trading. US/China trade concerns sparked selling. Support was established during the first two hours and the market bounced off of those lows. That support level will be tested again this morning.

Trump imposed tariffs on $200 billion worth of Chinese goods overnight. These tariffs were postponed during the trade negotiations and this deadline was known. Trump moved forward with them because China reneged on some of the terms last weekend. He is planning additional tariffs on $320 billion worth of goods and this would tax almost all imports from China at a 25% rate if it comes to fruition. Trump said that he is not in a hurry to strike a deal and that the additional $100 billion in tax revenue could be used to purchase grain from US farmers so that it can be redistributed for humanitarian aid in underdeveloped countries.

Vice Premier Liu is meeting with trade officials today and we are not likely to know the outcome until the market closes. China will not be happy with the new round of tariffs, but Trump had threatened to impose them months ago as a form of enforcement (to ensure that China adheres to the trade agreement). We will know if the tone has soured over the weekend. Xi has threatened to retaliate.

China has thrown the "kitchen sink" at their declining growth. Fiscal and monetary stimulus resulted in a small uptick in March, but April's numbers were soft. The official PMI declined .2% from March to April; exports fell from 14.2% to -2.7% and lending data was weaker than expected. Meanwhile, US job growth increased by 263,000 in April, Q1 GDP came in at 3.2% and ISM manufacturing/ISM services are both comfortably and expansion territory. The US is bargaining from a position of strength.

Earnings season has been good, but not strong enough to propel stocks through the all-time high. The back half of the cycle tends to be lackluster. Stocks are trading at the upper end of their valuation range and they are priced for good news.

Analysts were expecting a trade deal this week and the market rallied in anticipation of an agreement. This latest development will spark some profit-taking. If the tone is congenial after this weekend the market will tread water and it will evaluate progress. If the tone turns negative the market will test the 200-day MA next week (and possibly the 100-day MA). China reneged on many terms last weekend and I don't see them rolling over immediately. That would be a sign of desperation. In time they might return to the original terms to get the trade deal back on track.

I believe that at best the market will grind back to the $290 level next week. At worst, we could drop to SPY $274 (100-day MA).

Swing traders are in cash. We will wait for the dust to settle. During that time I will be evaluating global economic conditions. Global activity is stable, but soft. If that weakens, a trade deal with China won’t stop the bleeding. This is a critical juncture and the market could go either way.

Day traders need to be patient this morning. This is a binary event and the price action yesterday reminded me of an FOMC statement that was about to be released. Traders are sitting on their hands until the news comes out. The trading range during the first two hours yesterday was very tight. Use the first hour range as your guide. If we are above the high, favor the long side. If we are below the low, favor the short side. Support is at SPY $285 and resistance is at $290. If the market is flat-lining I will trade stock today. Relative strength and weakness has been easy to spot and I am looking for stocks with momentum. There are many good post-earnings plays.

.

.

Daily Bulletin Continues...