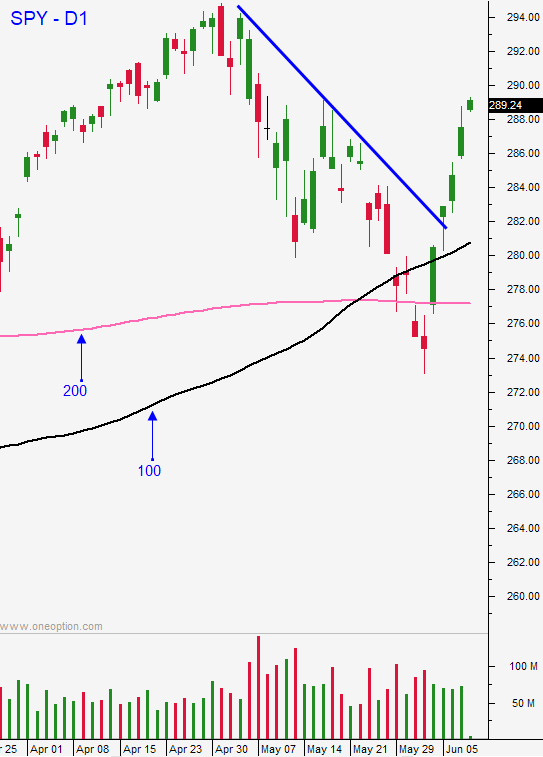

Gap Higher Could Reverse – Signs of Resistance Yesterday

Posted 9:30 AM ET - Yesterday the market gapped higher and it tried to advance early in the day. Profit-takers kept a lid on the action and the stocks closed on their low of the day. This left an inverted hammer on the chart and that would be bearish if the market closed lower today. As it stands, stocks are poised to rally this morning.

China will issue special purpose bonds and this stimulus has sparked buying this morning. All of the stimulus (fiscal and monetary) during the last year has kept China's growth rate at 6%. I believe they are preparing for a prolonged trade war. China will post industrial production and retail sales this Friday.

Last night Trump said that he will impose new tariffs on China if Xi does not attend the G20 meeting on June 28th. China said that it will retaliate if the US imposes new tariffs. The best scenario at this juncture is a "cease-fire" and a resolution to Huawei. If the company is blacklisted China will place restrictions on US companies. This would spook investors. One of Apple's primary suppliers (Foxcon) said that they can produce everything outside of China.

A trade war with Mexico has temporarily been avoided. They will send 6000 troops to the Guatemala border and they plan to substantially decrease border traffic in the next 45 days.

Global economic growth is slipping and central banks are easing. Investors are forced to buy equities since low bond yields are not keeping up with inflation.

The FOMC will meet next week. I believe it is too early to expect a rate cut, but the comments will be dovish.

Swing traders should remain short. We are going to ride out this bounce. Stocks might have a few more days of upside, but a trading range will settle in. Eventually, sellers will probe for support when slowing economic data points mount. Trade talks will stall and the market will stage the next leg lower.

Day traders should wait for the bid to be tested this morning. The gap up yesterday found resistance and I believe the rally this morning will retrace. I will be watching for early shorting opportunities. Once support is established the market will trade within the first hour range.

Look for a choppy upward bias for a few days. The trading range will be established and the "summer doldrums" will set in. It might be a few weeks before we see selling.

.

.

Daily Bulletin Continues...