Watch These Market Warning Signs – Favor the Short Side

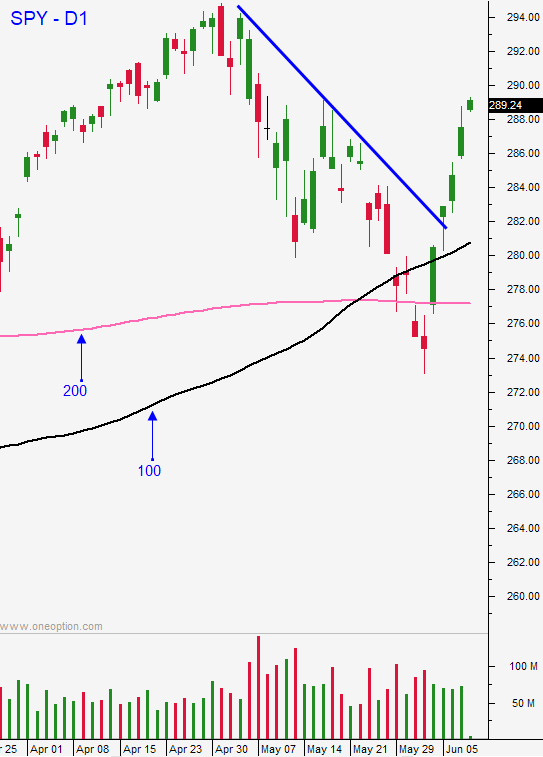

Posted 9:30 AM ET - The market hit resistance Monday and the bounce has stalled. Stocks have finished on their low of the day the last two sessions and we are seeing higher opens and lower closes. This is the first sign of strain and the market is likely to trade in a range for the next two weeks. The high of the range has been established and now we will probe for support.

Trump said that a trade deal with China might not happen last night. He also said that tariffs would increase if Xi did not attend the G20 meeting on June 28th. China is preparing for a prolonged battle and they introduced a new stimulus program yesterday (special purpose bonds for businesses). Manufacturers (Foxconn, Nintendo, Sharp and others) are moving production out of China. Huawei has been blacklisted by the US and if this is not resolved soon China will retaliate. This Friday China will post industrial production and retail sales. Soft numbers won't necessarily translate into a market decline. Traders will rationalize that the PBOC will ease. Monetary and fiscal stimulus are losing their effectiveness and it is harder and harder to artificially prop up the economy.

China imposed extradition laws on Hong Kong and criminals will be tried on the mainland. Protests in Hong Kong are breaking out and this is weighing on China’s market.

New tariffs on Mexico have been avoided. The border patrol will monitor illegal crossings and Mexico promised a substantial decline in the next 45 days.

Global interest rates are at historic lows and that is pushing investors into equities. Yields are not keeping pace with inflation and investors are forced to take additional risk just to maintain purchasing power (assuming that the market does not go down). This explains why the market is able to tread water when much of the news is negative.

The FOMC will meet next week and the statement should be dovish. I don't believe they will ease until September (at earliest). The market is pricing in two rate cuts this year and I believe that is overly optimistic.

Swing traders should remain short. We will use the all-time high as our stop on a closing basis. Stocks should start to retreat in the next two weeks and we will see another leg lower. Global economic conditions are deteriorating and the slowdown will gain momentum. The ECB and BOJ are out of monetary bullets and they can't stimulate growth.

Day traders should focus on the short side. I mentioned yesterday that a reversal was likely. Stocks immediately moved lower and we had a great day in the chat room. We've had two days where the market opened on the high and closed on the low. Late day selling has prevented bounces. These are warning signs and I believe the market will drift lower today.

The low-end of the trading range will be established in the next few days and then we will spend a week or two in that range. Support will be tested and eventually the next leg lower will begin.

Take profits on long positions.

.

.

Daily Bulletin Continues...